Valuing Household Goods For Probate: A Comprehensive Guide

Valuing Household Goods for Probate: A Comprehensive Guide

Related Articles: Valuing Household Goods for Probate: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Valuing Household Goods for Probate: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Valuing Household Goods for Probate: A Comprehensive Guide

Probate is the legal process of administering the estate of a deceased person, including the distribution of their assets to beneficiaries. A critical component of this process involves accurately valuing the deceased’s belongings, particularly household goods. This valuation serves to ensure fairness and transparency in the distribution of the estate and can impact tax liabilities. While the process might seem daunting, understanding the principles and methods involved can empower beneficiaries and executors to navigate it effectively.

The Importance of Accurate Valuation

The accurate valuation of household goods is crucial for several reasons:

- Fair Distribution: A precise valuation ensures that each beneficiary receives a fair share of the estate’s assets, reflecting the true worth of the items.

- Tax Obligations: The value of household goods can influence the estate’s overall value, impacting potential tax liabilities.

- Beneficiary Disputes: Accurate valuations help prevent disputes among beneficiaries over the perceived value of specific items.

- Insurance Claims: In cases where the deceased’s household goods were insured, a proper valuation can aid in settling claims with the insurance company.

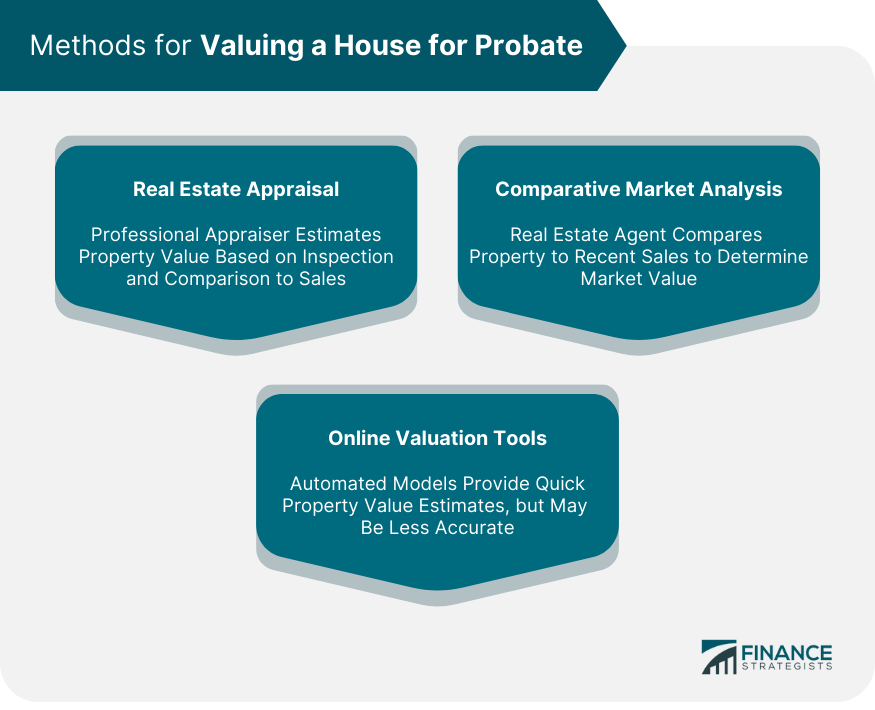

Methods for Valuing Household Goods

There are several methods for valuing household goods for probate, each with its own advantages and disadvantages. The most common approaches include:

1. Appraisal by a Qualified Professional:

- Description: Hiring a certified appraiser specializing in personal property is the most accurate and reliable method. Appraisers possess extensive knowledge of market trends, antiques, and collectibles, enabling them to provide detailed valuations based on condition, age, rarity, and provenance.

- Benefits: Provides the most credible and defensible valuation, minimizing the risk of disputes.

- Drawbacks: Can be costly, especially for large estates with numerous items.

2. Online Valuation Resources:

- Description: Websites like eBay, Etsy, and specialized antique platforms offer online valuation tools and databases. These resources allow users to search for similar items and estimate their market value based on sales data and expert opinions.

- Benefits: Provides a quick and relatively inexpensive option for preliminary valuations.

- Drawbacks: Online valuations may not be accurate or reliable for unique or rare items.

3. Comparison with Similar Items:

- Description: This method involves researching comparable items sold in local markets, auction houses, or online marketplaces. By comparing the prices of similar items, a reasonable valuation for the deceased’s household goods can be estimated.

- Benefits: Provides a practical approach for common household items with readily available market data.

- Drawbacks: Requires extensive research and may not accurately reflect the value of unique or antique items.

4. Auction or Estate Sale:

- Description: Holding an auction or estate sale allows the market to determine the value of the household goods through competitive bidding.

- Benefits: Provides a transparent and objective method for valuing items.

- Drawbacks: Can be time-consuming and requires significant effort to organize and manage.

5. Personal Assessment:

- Description: This approach involves the executor or beneficiaries making their own assessment of the value of household goods based on their personal knowledge and experience.

- Benefits: Can be useful for items with sentimental value or those difficult to value using other methods.

- Drawbacks: Highly subjective and prone to bias, potentially leading to disputes.

Tips for Valuing Household Goods

- Document Thoroughly: Maintain detailed records of all items, including descriptions, condition, age, and any relevant documentation (e.g., purchase receipts, appraisals).

- Consider Condition: The condition of the item significantly impacts its value. Damaged, worn, or incomplete items are typically worth less than those in excellent condition.

- Research Market Trends: Stay updated on market trends for specific types of items, as values can fluctuate based on supply, demand, and popularity.

- Seek Professional Advice: Consult with a qualified appraiser or estate attorney for guidance on complex valuations or items with significant value.

- Transparency and Open Communication: Maintain transparency with all beneficiaries and ensure clear communication regarding the valuation process and any decisions made.

FAQs about Valuing Household Goods for Probate

1. What types of household goods need to be valued?

All tangible assets belonging to the deceased, including furniture, appliances, jewelry, artwork, collectibles, and personal belongings, should be valued for probate.

2. When should I seek professional appraisal services?

It’s recommended to seek professional appraisal services for items of significant value, antiques, collectibles, or items with unique or historical significance.

3. How do I handle sentimental items?

Sentimental items can be valued based on their emotional value or, if applicable, their fair market value. Consider discussing the importance of such items with beneficiaries to reach a mutually agreeable solution.

4. Can I value items based on their original purchase price?

Generally, the original purchase price is not a reliable indicator of current market value. Valuations should reflect the current market value, considering factors like age, condition, and demand.

5. What if I cannot find comparable items for valuation?

If finding comparable items proves difficult, consult with a qualified appraiser who can use their expertise to estimate the item’s value.

6. Can I use online valuation tools for all items?

While online valuation tools can be helpful for common household items, they may not provide accurate valuations for unique, antique, or collectible items. Seek professional guidance for such items.

7. How do I handle items with no market value?

Items with no market value, such as personal effects or sentimental belongings, can be distributed among beneficiaries based on their emotional significance or, if desired, disposed of appropriately.

Conclusion

Valuing household goods for probate is an essential step in ensuring a fair and transparent distribution of the deceased’s estate. By understanding the various methods and considerations involved, executors and beneficiaries can navigate this process effectively. While seeking professional guidance is always recommended for complex or valuable items, utilizing a combination of research, online resources, and personal assessment can provide a reasonable basis for valuing the deceased’s belongings. Ultimately, the goal is to reach a fair and mutually agreeable outcome that honors the deceased’s legacy and reflects the true value of their possessions.

Closure

Thus, we hope this article has provided valuable insights into Valuing Household Goods for Probate: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply