Understanding Liquid Assets: A Guide To Financial Flexibility And Security

Understanding Liquid Assets: A Guide to Financial Flexibility and Security

Related Articles: Understanding Liquid Assets: A Guide to Financial Flexibility and Security

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding Liquid Assets: A Guide to Financial Flexibility and Security. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Liquid Assets: A Guide to Financial Flexibility and Security

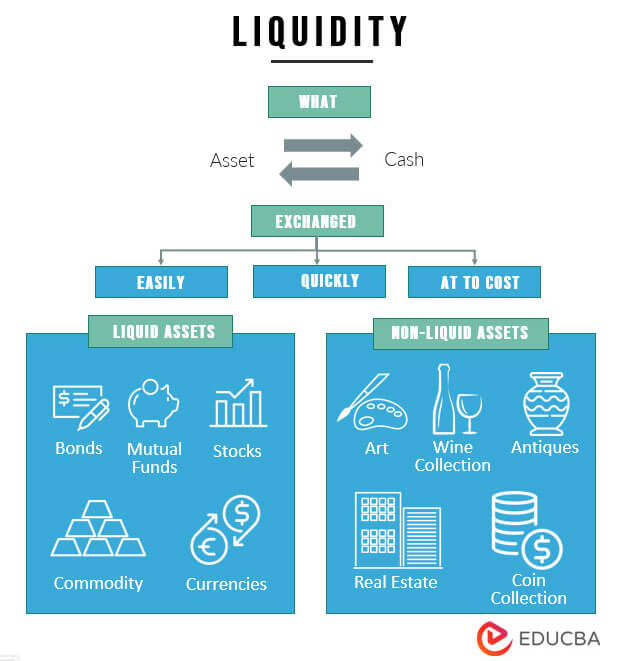

In the realm of personal finance, the term "liquid assets" holds significant weight. It refers to assets that can be readily converted into cash without incurring significant loss in value or requiring extensive time. These assets serve as the lifeblood of financial flexibility, enabling individuals and businesses to navigate unforeseen circumstances, seize opportunities, and achieve their financial goals.

The Essence of Liquidity:

Liquidity, in its essence, signifies the ease with which an asset can be transformed into cash. This transformation process is pivotal in financial management, as it empowers individuals and organizations to:

- Address immediate financial needs: Liquid assets provide a safety net during emergencies, such as unexpected medical expenses, job loss, or home repairs.

- Capitalize on opportunities: When a lucrative investment opportunity arises, liquid assets allow individuals to seize the moment without delay.

- Manage cash flow: Liquid assets act as a buffer against fluctuations in income or expenditure, ensuring smooth cash flow management.

Key Types of Liquid Assets:

Several asset classes fall under the umbrella of liquid assets, each with its own characteristics and implications:

1. Cash and Cash Equivalents:

- Cash: This includes physical currency, checking and savings accounts, and money market accounts. Cash is the most liquid asset, readily available for immediate use.

- Cash Equivalents: These are short-term investments that can be easily converted to cash with minimal risk. Examples include treasury bills, commercial paper, and money market funds.

2. Marketable Securities:

- Stocks: Shares of publicly traded companies can be readily bought and sold on stock exchanges, providing relatively high liquidity.

- Bonds: Debt securities issued by governments or corporations can be traded on bond markets, offering varying levels of liquidity depending on factors like maturity and credit rating.

- Mutual Funds: These funds pool money from multiple investors to invest in a diversified portfolio of securities, providing liquidity through regular trading.

3. Liquid Investments:

- Certificates of Deposit (CDs): CDs offer fixed interest rates for a specific period, but early withdrawal may incur penalties, impacting liquidity.

- High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts, but may come with restrictions on withdrawals.

- Money Market Accounts: These accounts offer a balance between liquidity and interest earning potential.

4. Liquid Assets in a Business Context:

- Accounts Receivable: Businesses with healthy accounts receivable have a reliable source of liquid assets, as customers are expected to pay their invoices promptly.

- Inventory: For businesses with high inventory turnover, inventory can be considered a liquid asset, as it is readily converted into cash through sales.

Benefits of Maintaining Liquid Assets:

Maintaining an adequate level of liquid assets offers numerous benefits:

- Financial Security: Liquid assets provide a cushion against unexpected financial shocks, ensuring stability and peace of mind.

- Investment Opportunities: Having readily available cash allows individuals to capitalize on emerging investment opportunities, potentially enhancing returns.

- Debt Management: Liquid assets can be used to repay debts, improving credit scores and reducing interest payments.

- Business Growth: Liquid assets provide businesses with the necessary capital for expansion, acquisitions, or innovation.

Determining the Right Level of Liquidity:

The ideal level of liquid assets varies based on individual circumstances, financial goals, and risk tolerance. Generally, a healthy balance should be struck between:

- Liquidity Needs: Factors such as age, income, dependents, and emergency preparedness influence the required level of liquid assets.

- Investment Goals: Long-term investment goals may necessitate a lower level of liquidity, while short-term goals may require higher liquidity.

- Risk Tolerance: Individuals with a higher risk tolerance may opt for a lower level of liquid assets, while those with lower tolerance may prefer greater liquidity.

Tips for Managing Liquid Assets:

- Track Your Liquid Assets: Regularly monitor your cash flow, checking and savings accounts, and other liquid assets to ensure sufficient funds for immediate needs.

- Set Emergency Fund Goals: Aim to accumulate at least three to six months’ worth of living expenses in a readily accessible emergency fund.

- Diversify Your Liquid Assets: Spread your liquid assets across different accounts and investment vehicles to minimize risk and maximize potential returns.

- Review and Adjust: Periodically review your liquidity strategy, considering changes in your financial situation, goals, and risk tolerance.

FAQs on Liquid Assets:

Q: How much liquid assets should I have?

A: The ideal amount of liquid assets depends on individual circumstances. A general guideline is to have three to six months’ worth of living expenses readily available in an emergency fund. However, consider your age, income, dependents, and risk tolerance.

Q: What is the difference between liquid and illiquid assets?

A: Liquid assets can be easily converted into cash without significant loss in value or time. Illiquid assets, such as real estate or collectibles, require more time and effort to sell, often involving potential price fluctuations.

Q: How can I increase my liquidity?

A: You can increase your liquidity by:

- Reducing unnecessary expenses.

- Increasing income through a side hustle or salary negotiation.

- Selling illiquid assets.

- Investing in liquid assets, such as stocks or bonds.

Q: What are the risks associated with liquid assets?

A: While liquid assets offer flexibility and security, they also carry risks:

- Inflation: The purchasing power of cash can erode over time due to inflation.

- Interest Rates: Low interest rates on savings accounts can reduce the return on liquid assets.

- Market Volatility: Stock and bond markets can experience fluctuations, impacting the value of liquid assets.

Conclusion:

Liquid assets are the cornerstone of financial flexibility and security. They provide the means to address immediate needs, capitalize on opportunities, and navigate unforeseen circumstances. By understanding the different types of liquid assets, their benefits, and the importance of maintaining an appropriate level of liquidity, individuals and businesses can achieve greater financial stability and reach their financial goals. Remember, a proactive approach to managing liquid assets is essential for securing a financially sound future.

Closure

Thus, we hope this article has provided valuable insights into Understanding Liquid Assets: A Guide to Financial Flexibility and Security. We appreciate your attention to our article. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply