The Enduring Value Of Homeownership: A Comprehensive Exploration

The Enduring Value of Homeownership: A Comprehensive Exploration

Related Articles: The Enduring Value of Homeownership: A Comprehensive Exploration

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Enduring Value of Homeownership: A Comprehensive Exploration. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Enduring Value of Homeownership: A Comprehensive Exploration

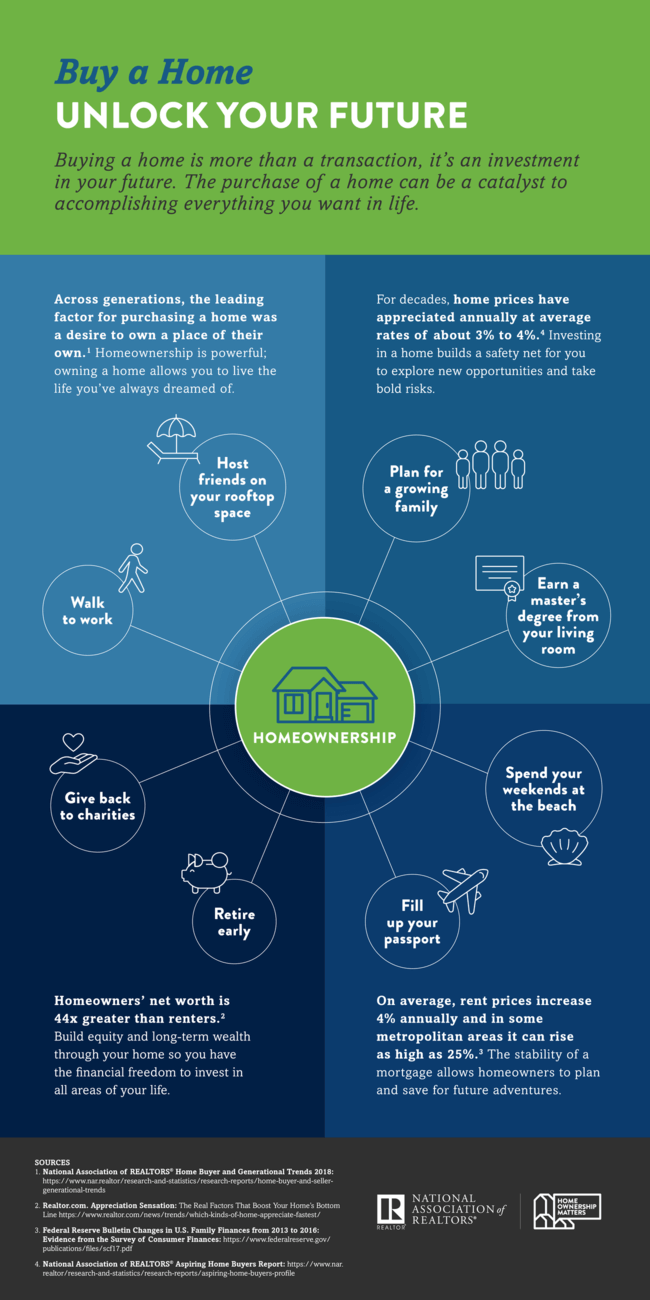

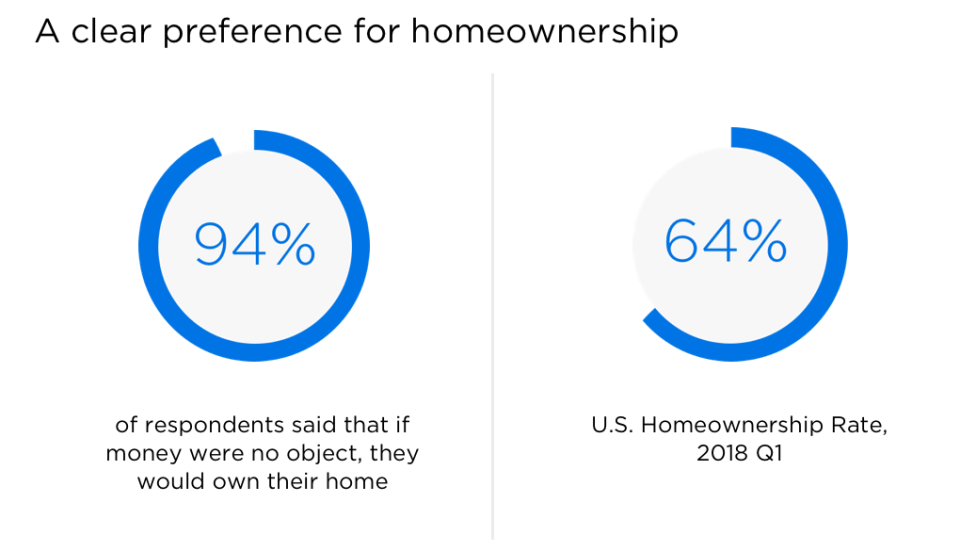

The concept of homeownership is deeply ingrained in the fabric of society, often serving as a cornerstone of financial security and personal fulfillment. While the economic landscape and societal priorities evolve, the fundamental value proposition of owning a home remains compelling. This article aims to provide a comprehensive exploration of why owning a home continues to be a significant asset, delving into its multifaceted benefits and addressing common queries surrounding this investment.

The Tangible and Intangible Benefits of Homeownership

1. Building Equity and Wealth:

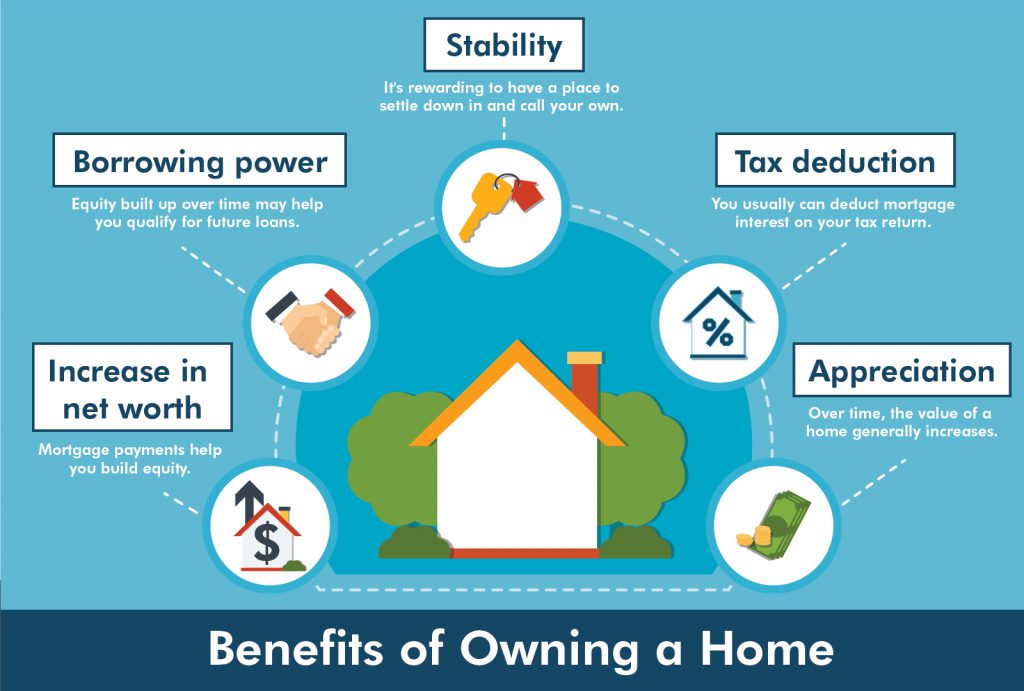

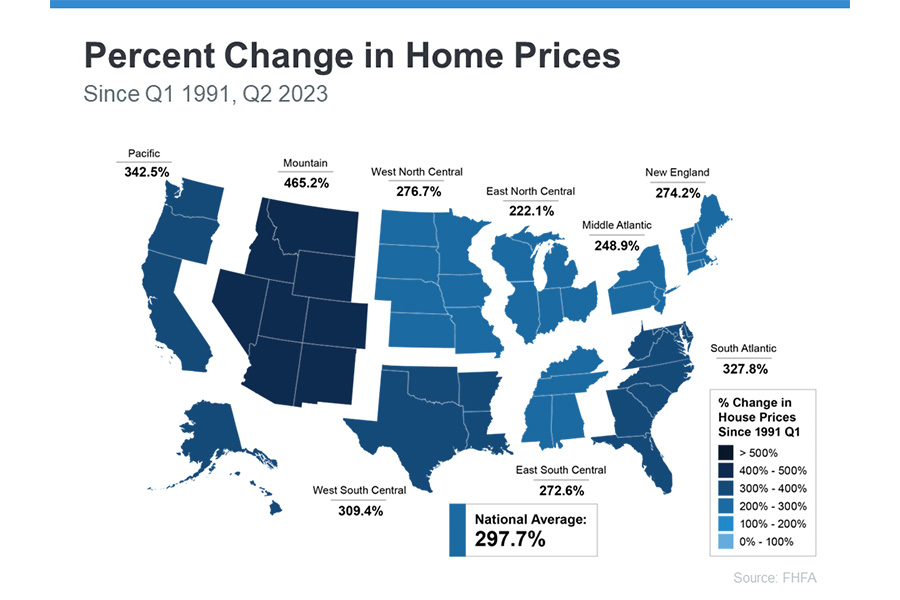

Owning a home allows individuals to build equity over time. With each mortgage payment, a portion goes towards paying down the principal, gradually increasing the homeowner’s ownership stake in the property. This equity represents a tangible asset that can be accessed through refinancing, home equity loans, or ultimately, sale of the property. Moreover, appreciation in property value over time further enhances equity, contributing to wealth accumulation.

2. Tax Advantages:

Homeownership offers various tax advantages, including deductions for mortgage interest and property taxes. These deductions can significantly reduce annual tax liabilities, effectively lowering the overall cost of homeownership. Additionally, homeowners may be eligible for tax credits or deductions for energy-efficient improvements or home renovations, further enhancing the financial benefits.

3. Stability and Control:

Owning a home provides a sense of stability and control over one’s living environment. Unlike renting, where lease agreements expire and rent prices can fluctuate, homeowners enjoy the security of a fixed mortgage payment and the ability to customize their space according to their needs and preferences. This stability fosters a sense of belonging and allows for long-term planning, promoting a more secure and predictable lifestyle.

4. Forced Savings:

Mortgage payments act as a form of forced savings, encouraging financial discipline and promoting a long-term savings habit. Regular mortgage payments contribute to building equity and gradually reducing debt, fostering financial responsibility and a sense of accomplishment. This disciplined approach to savings can benefit other financial goals, such as retirement planning or education savings.

5. Potential for Rental Income:

Homeowners can leverage their property as an investment by renting out a portion of it, generating additional income. This can be particularly beneficial for those with multi-family homes or those seeking to supplement their income. Rental income can help offset mortgage payments, potentially leading to a faster path to equity accumulation.

6. A Safe Haven in Uncertain Times:

In times of economic uncertainty, owning a home can provide a sense of security and stability. While market fluctuations may impact property values, homeownership offers a tangible asset that can be a source of comfort and financial resilience during turbulent periods.

7. A Foundation for Family and Community:

For many, owning a home is an integral part of family life and community engagement. It provides a stable and nurturing environment for children to grow and thrive, fostering a sense of belonging and creating lasting memories. Owning a home can also strengthen connections with neighbors and contribute to the overall well-being of the community.

Addressing Common Concerns and Queries

1. Affordability:

Homeownership can be a significant financial commitment, and affordability is a major concern for many. However, it’s crucial to recognize that homeownership is not a one-size-fits-all solution. There are various options available, including government programs, down payment assistance, and flexible mortgage terms, that can make homeownership attainable for a wider range of individuals.

2. Maintenance and Repair Costs:

Homeowners are responsible for maintaining and repairing their properties. While this can be a financial burden, it’s important to consider the long-term benefits of owning a home. Regular maintenance can help prevent costly repairs down the line, and homeowners can budget for these expenses to avoid unexpected financial strain.

3. Market Fluctuations:

Property values can fluctuate due to various economic factors. While this can be a concern, it’s important to remember that homeownership is a long-term investment. Over time, property values tend to appreciate, and any short-term fluctuations should be viewed within the context of a longer investment horizon.

4. Limited Mobility:

Owning a home can limit mobility compared to renting. Selling a home can be a lengthy process, and finding a new home that meets specific needs may require time and effort. However, this limitation can be mitigated by careful planning and by considering the long-term benefits of owning a home in a desirable location.

5. Financial Risk:

Homeownership involves financial risk, including potential losses due to market downturns or unforeseen events. However, by carefully considering financial capacity, obtaining a mortgage that aligns with one’s budget, and establishing an emergency fund, homeowners can mitigate these risks and enjoy the benefits of homeownership.

Tips for Successful Homeownership

1. Financial Planning:

Before embarking on the homeownership journey, it’s crucial to have a solid financial plan. This involves assessing income, expenses, and debt levels, setting a realistic budget, and saving for a down payment. Consulting with a financial advisor can provide personalized guidance and ensure financial readiness for homeownership.

2. Location and Property Research:

Thorough research is essential in choosing the right location and property. Consider factors such as neighborhood amenities, school districts, commuting distance, and future growth potential. Researching property values, recent sales, and local market trends can help make informed decisions.

3. Mortgage Shopping:

Compare mortgage rates and terms from multiple lenders to secure the most favorable financing options. Consider factors such as interest rates, loan terms, and closing costs. Working with a mortgage broker can streamline the process and ensure access to competitive offers.

4. Home Inspection and Appraisal:

Before finalizing the purchase, obtain a professional home inspection to identify any potential issues. An appraisal will determine the property’s fair market value, ensuring that the purchase price aligns with current market conditions.

5. Regular Maintenance and Budgeting:

Establish a maintenance schedule for regular inspections and repairs. Budget for routine maintenance costs, including landscaping, plumbing, electrical, and HVAC systems. This proactive approach can prevent costly repairs and ensure the longevity of the home.

6. Building Equity and Financial Discipline:

Make extra mortgage payments whenever possible to accelerate equity building and reduce debt. This disciplined approach to financial management can lead to faster wealth accumulation and a stronger financial position.

Conclusion

Owning a home remains a significant asset, offering tangible and intangible benefits that contribute to financial security, personal fulfillment, and community engagement. While homeownership involves financial commitment and responsibilities, its long-term advantages and the sense of stability and control it provides make it a compelling investment for individuals and families seeking to build a secure and fulfilling future. By carefully planning, researching, and managing finances, homeownership can be a rewarding and empowering experience, serving as a foundation for a prosperous and meaningful life.

![The Path to Homeownership [INFOGRAPHIC] Blog](https://www.mcsellsbythesea.com/wp-content/uploads/2020/12/Homeownership-1.jpg)

Closure

Thus, we hope this article has provided valuable insights into The Enduring Value of Homeownership: A Comprehensive Exploration. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply