The Anatomy Of Household Costs: A Comprehensive Guide

The Anatomy of Household Costs: A Comprehensive Guide

Related Articles: The Anatomy of Household Costs: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to The Anatomy of Household Costs: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Anatomy of Household Costs: A Comprehensive Guide

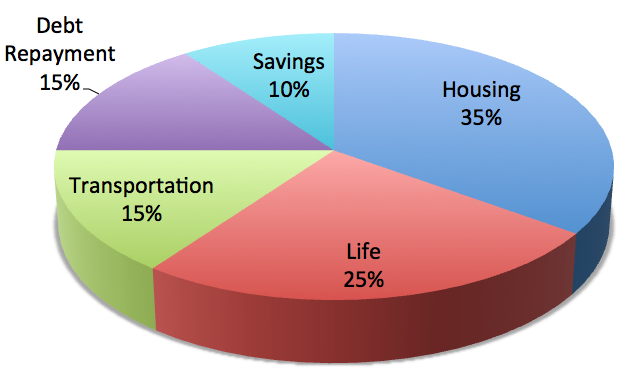

Managing household finances is a crucial aspect of personal well-being. Understanding the various components that contribute to household costs empowers individuals to make informed financial decisions, optimize spending, and achieve financial stability. This comprehensive guide provides a detailed breakdown of the major categories of household expenses, exploring their significance and offering insights into effective management strategies.

1. Housing:

- Mortgage or Rent: This constitutes the largest single expenditure for most households. The amount varies significantly based on location, property size, and market conditions.

- Property Taxes: These are annual levies imposed by local governments on real estate ownership.

- Home Insurance: This provides financial protection against damage or loss to the property due to unforeseen events like fire, theft, or natural disasters.

- Utilities: This category encompasses essential services like electricity, gas, water, and sewage. Costs fluctuate based on usage patterns and seasonal variations.

- Home Maintenance and Repairs: This includes routine maintenance like landscaping, plumbing repairs, appliance replacements, and general upkeep.

2. Food and Groceries:

- Food at Home: This covers the cost of groceries, fresh produce, and pantry staples. Budgeting for this category requires considering dietary preferences, household size, and meal planning strategies.

- Food Away from Home: This includes expenses on dining out, takeout, and meal delivery services.

- Alcohol and Tobacco: These are discretionary items that can significantly impact household budgets, particularly if consumed frequently.

3. Transportation:

- Vehicle Ownership: This includes car payments, insurance, fuel, maintenance, and repairs.

- Public Transportation: This encompasses costs associated with buses, trains, and other public transit systems.

- Ride-Sharing Services: This category covers expenses on ride-hailing services like Uber or Lyft.

- Tolls and Parking: These are fees associated with using toll roads and parking facilities.

4. Healthcare:

- Health Insurance Premiums: These are monthly payments for health insurance coverage, which provides access to medical services.

- Out-of-Pocket Medical Expenses: This includes co-pays, deductibles, prescription medications, and other healthcare costs not covered by insurance.

5. Personal Care:

- Clothing and Footwear: This covers expenses on new apparel, shoes, and accessories.

- Personal Hygiene Products: This includes costs for toiletries, cosmetics, and other grooming items.

- Hair and Beauty Services: This encompasses expenses on haircuts, salon treatments, and other personal care services.

6. Entertainment and Recreation:

- Movies, Theater, and Concerts: These are discretionary expenses associated with attending entertainment events.

- Hobbies and Sports: This includes costs associated with pursuing hobbies, engaging in sports activities, or attending sporting events.

- Travel and Vacations: This category covers expenses related to travel, lodging, and activities during vacations.

7. Education:

- Tuition and Fees: This covers the cost of attending educational institutions, including schools, colleges, and universities.

- Books and Supplies: This includes expenses on textbooks, stationery, and other educational materials.

8. Childcare:

- Daycare and Preschool: This covers expenses associated with childcare services for young children.

- After-School Programs: This includes costs for programs that provide supervision and activities for school-aged children after school hours.

9. Personal Savings and Debt:

- Retirement Savings: This includes contributions to retirement accounts such as 401(k)s or IRAs.

- Debt Repayment: This covers payments on loans, credit cards, and other forms of debt.

10. Other Expenses:

- Gifts and Donations: This includes expenses on gifts for birthdays, holidays, and other occasions, as well as charitable donations.

- Subscriptions and Memberships: This covers expenses on subscriptions to streaming services, gym memberships, and other recurring subscriptions.

- Insurance: This includes costs for life insurance, disability insurance, and other types of insurance coverage.

Understanding the Importance of Household Costs:

Knowledge of household costs is essential for several reasons:

- Financial Planning: By understanding the components of household expenses, individuals can effectively budget and allocate funds to different categories.

- Debt Management: Tracking household costs helps identify areas where spending can be reduced, thereby facilitating debt reduction and improving financial stability.

- Savings and Investments: Analyzing household expenses allows individuals to prioritize savings goals and make informed decisions about investment strategies.

- Financial Security: Comprehensive understanding of household costs empowers individuals to make informed decisions about their financial future, ensuring financial security and well-being.

FAQs about Household Costs:

- Q: How do I track my household costs?

- A: Utilize budgeting tools, spreadsheets, or financial apps to track income and expenses, categorize spending, and monitor progress towards financial goals.

- Q: What are some common budgeting methods?

- A: Popular methods include the 50/30/20 rule, zero-based budgeting, and envelope budgeting.

- Q: How can I reduce my household costs?

- A: Explore cost-saving strategies like negotiating bills, reducing energy consumption, meal planning, utilizing public transportation, and finding discounts on essential goods.

- Q: What are some resources for managing household costs?

- A: Seek guidance from financial advisors, credit counseling agencies, and online resources offering budgeting tips and financial literacy tools.

Tips for Managing Household Costs:

- Create a Budget: Develop a detailed budget that outlines income and expenses, categorizing spending and allocating funds effectively.

- Track Spending: Regularly monitor spending habits, identifying areas where costs can be reduced.

- Negotiate Bills: Contact service providers to negotiate lower rates for utilities, insurance, and other recurring bills.

- Shop Smart: Utilize coupons, loyalty programs, and comparison shopping to secure discounts on groceries, clothing, and other essential items.

- Reduce Energy Consumption: Implement energy-saving measures like using energy-efficient appliances, reducing water usage, and maximizing natural light.

- Utilize Public Transportation: Explore the use of public transportation to reduce fuel costs and vehicle maintenance expenses.

- Consider Homeownership vs. Renting: Carefully evaluate the financial implications of owning versus renting a home, considering factors like mortgage payments, property taxes, and maintenance costs.

Conclusion:

Understanding the intricacies of household costs is crucial for achieving financial well-being. By meticulously tracking expenses, implementing effective budgeting strategies, and exploring cost-saving opportunities, individuals can gain control over their finances, prioritize financial goals, and secure a more stable and prosperous future. Armed with knowledge and proactive strategies, individuals can navigate the complexities of household costs and achieve greater financial freedom.

Closure

Thus, we hope this article has provided valuable insights into The Anatomy of Household Costs: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply