Safeguarding Your Home: A Comprehensive Guide To Household Item Insurance

Safeguarding Your Home: A Comprehensive Guide to Household Item Insurance

Related Articles: Safeguarding Your Home: A Comprehensive Guide to Household Item Insurance

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Safeguarding Your Home: A Comprehensive Guide to Household Item Insurance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Safeguarding Your Home: A Comprehensive Guide to Household Item Insurance

Protecting the belongings that make up your home is a crucial aspect of financial security. From furniture and electronics to personal items and valuables, these possessions represent years of investment and hold sentimental value. However, unforeseen events like fires, floods, theft, and natural disasters can threaten to wipe out these investments in an instant. This is where insurance that covers household items plays a vital role, providing a financial safety net to mitigate losses and help you rebuild your life.

Understanding the Scope of Coverage

Household item insurance, often known as homeowners insurance or contents insurance, acts as a financial shield against various perils that can damage or destroy your possessions. This type of insurance typically covers:

- Personal Property: This includes furniture, appliances, electronics, clothing, bedding, and other items used for daily living.

- Valuables: Certain policies offer specific coverage for valuable items like jewelry, artwork, antiques, and collections, often requiring additional premiums or separate endorsements.

- Personal Liability: This covers you against financial claims if someone is injured on your property or if your actions cause damage to someone else’s property.

- Additional Living Expenses: In the event of a covered loss that makes your home uninhabitable, this coverage helps pay for temporary housing, meals, and other essential expenses while your home is being repaired or rebuilt.

Types of Household Item Insurance

Several types of insurance policies cater to different needs and circumstances:

- Homeowners Insurance: This comprehensive policy provides coverage for both the structure of your home and your personal belongings. It is typically bundled with liability coverage and often includes additional benefits like medical payments for guests injured on your property.

- Renters Insurance: Designed for tenants, this policy covers personal belongings against perils like fire, theft, and vandalism. It also provides liability coverage for injuries or property damage caused by the renter.

- Condominium Insurance: This policy covers personal belongings within a condominium unit and includes liability coverage for the unit owner. It does not cover the building itself, which is typically insured by the condominium association.

Key Considerations When Choosing Coverage

Selecting the right household item insurance policy involves careful consideration of several factors:

- Coverage Limits: Determine the total value of your possessions and choose a policy with sufficient coverage to replace or repair them in the event of a loss.

- Deductible: This is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible usually translates to lower premiums, but you will bear a larger portion of the cost in case of a claim.

- Perils Covered: Ensure your policy covers the specific risks you face in your area, such as floods, earthquakes, or windstorms.

- Replacement Cost Coverage: This option reimburses you for the cost of replacing damaged items with new ones, rather than their depreciated value.

- Personal Liability Coverage: Determine the appropriate level of liability coverage based on your individual needs and potential risks.

- Additional Coverage Options: Explore optional endorsements for valuable items, water damage, or other specific concerns.

Benefits of Household Item Insurance

Investing in household item insurance offers numerous benefits:

- Financial Protection: It provides a financial safety net to help you recover from unexpected losses and rebuild your life.

- Peace of Mind: Knowing your belongings are protected against unforeseen events can alleviate stress and provide peace of mind.

- Legal Protection: Liability coverage safeguards you against lawsuits arising from injuries or property damage caused by you or your family members.

- Flexibility: Policies can be customized to meet your specific needs and budget.

Frequently Asked Questions

Q: What is the difference between homeowners insurance and renters insurance?

A: Homeowners insurance covers both the structure of your home and your personal belongings, while renters insurance only covers your personal property.

Q: How much coverage do I need?

A: The amount of coverage you need depends on the total value of your possessions. It is advisable to create an inventory of your belongings, including their estimated replacement cost, to determine the appropriate coverage amount.

Q: What is a deductible?

A: The deductible is the amount you pay out-of-pocket before your insurance company covers the remaining cost of a claim.

Q: What are some common exclusions from household item insurance?

A: Common exclusions include acts of war, intentional damage, and certain types of wear and tear.

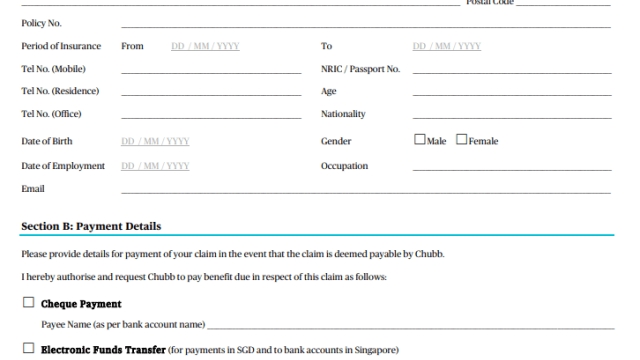

Q: How do I file a claim?

A: Contact your insurance company promptly after a covered event and follow their instructions for filing a claim. Be prepared to provide documentation of your loss, such as photographs, receipts, and inventory lists.

Tips for Maximizing Your Coverage

- Maintain an inventory of your belongings: This will facilitate accurate claim filing and ensure you receive appropriate compensation for your losses.

- Consider replacement cost coverage: This option provides reimbursement for the cost of replacing damaged items with new ones, ensuring you have adequate funds to rebuild your life.

- Review your policy regularly: Ensure your coverage remains adequate as your belongings and needs change over time.

- Take preventative measures: Implement safety measures like smoke detectors, fire extinguishers, and security systems to minimize the risk of loss.

Conclusion

Household item insurance is an essential investment for anyone who wants to protect their financial well-being. It provides a safety net against unforeseen events that can threaten the security of your home and belongings. By understanding the different types of policies, key considerations, and benefits, you can choose the right coverage to meet your specific needs and enjoy peace of mind knowing that your possessions are protected. Remember to review your policy regularly, maintain an inventory of your belongings, and take preventative measures to minimize the risk of loss. By taking these steps, you can ensure that you are well-prepared to navigate any challenges that may arise and safeguard your financial future.

Closure

Thus, we hope this article has provided valuable insights into Safeguarding Your Home: A Comprehensive Guide to Household Item Insurance. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply