Navigating The World Of Housekeeping Items: Understanding HSN Codes And GST Rates

Navigating the World of Housekeeping Items: Understanding HSN Codes and GST Rates

Related Articles: Navigating the World of Housekeeping Items: Understanding HSN Codes and GST Rates

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the World of Housekeeping Items: Understanding HSN Codes and GST Rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Housekeeping Items: Understanding HSN Codes and GST Rates

Housekeeping, an essential aspect of maintaining a comfortable and hygienic living environment, involves a wide range of products. Understanding the Harmonized System Nomenclature (HSN) codes and Goods and Services Tax (GST) rates associated with these items is crucial for both consumers and businesses. This comprehensive guide aims to demystify this information, providing clarity and insight into the complexities of taxation surrounding housekeeping products.

Understanding HSN Codes and GST Rates

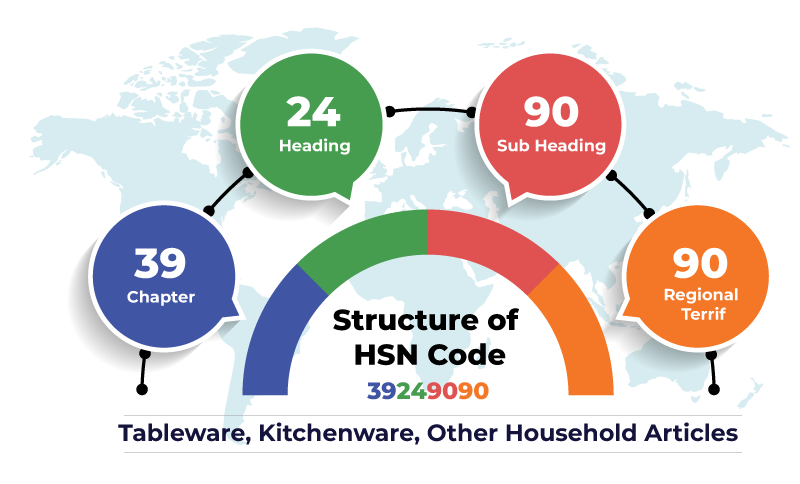

The HSN code is a six-digit internationally standardized system used to classify traded goods. Each HSN code represents a specific product or category, facilitating efficient tracking and management of trade activities. In India, the GST regime utilizes HSN codes for categorizing goods and assigning corresponding GST rates.

Importance of HSN Codes and GST Rates

Understanding HSN codes and GST rates is essential for:

- Consumers: Being aware of these codes enables informed purchasing decisions, ensuring transparency and clarity regarding the price breakdown of products.

- Businesses: Correctly applying HSN codes and GST rates ensures compliance with tax regulations, minimizing the risk of penalties and streamlining financial transactions.

- Government: Accurate classification of goods through HSN codes allows the government to effectively monitor and manage tax revenue collection.

Housekeeping Items: A Detailed Breakdown

Let’s delve into the HSN codes and GST rates applicable to various housekeeping items:

1. Cleaning Supplies:

- Detergents and Cleaning Agents (HSN Code 3402): This category encompasses a wide range of cleaning agents, including liquid detergents, powders, and specialized cleaning solutions for various surfaces. The GST rate for these products is typically 18%.

- Disinfectants (HSN Code 3808): Disinfectants, designed to eliminate harmful microorganisms, are categorized under this code and often attract a GST rate of 18%.

- Polishes and Waxes (HSN Code 3405): Polishes and waxes, used for maintaining the shine and protecting surfaces like furniture and floors, are typically subject to a GST rate of 18%.

- Sprays and Aerosols (HSN Code 3824): Cleaning sprays and aerosols, offering convenience and efficiency, fall under this code and generally attract a GST rate of 18%.

2. Kitchenware and Tableware:

- Cookware (HSN Code 7323): Cookware, encompassing pots, pans, and other utensils used for cooking, typically falls under a GST rate of 18%.

- Tableware (HSN Code 7324): Tableware, including plates, bowls, cutlery, and serving dishes, is generally subject to a GST rate of 18%.

- Kitchen Appliances (HSN Code 8509): Kitchen appliances such as blenders, mixers, and food processors fall under this code and are typically subject to a GST rate of 18%.

- Glassware (HSN Code 7013): Glassware used for serving and drinking, including glasses, mugs, and decanters, is usually subject to a GST rate of 18%.

3. Bedding and Linen:

- Bed Linen (HSN Code 6302): Bed linen, including sheets, pillowcases, and duvet covers, is generally subject to a GST rate of 12%.

- Towels (HSN Code 6306): Towels, used for personal hygiene and drying purposes, are typically subject to a GST rate of 12%.

- Blankets (HSN Code 6301): Blankets, providing warmth and comfort, are usually subject to a GST rate of 12%.

4. Bathroom Accessories:

- Bath Towels (HSN Code 6306): Bath towels, specifically designed for bathing and drying, are generally subject to a GST rate of 12%.

- Bathroom Fittings (HSN Code 8481): Bathroom fittings, including taps, showers, and sinks, are typically subject to a GST rate of 18%.

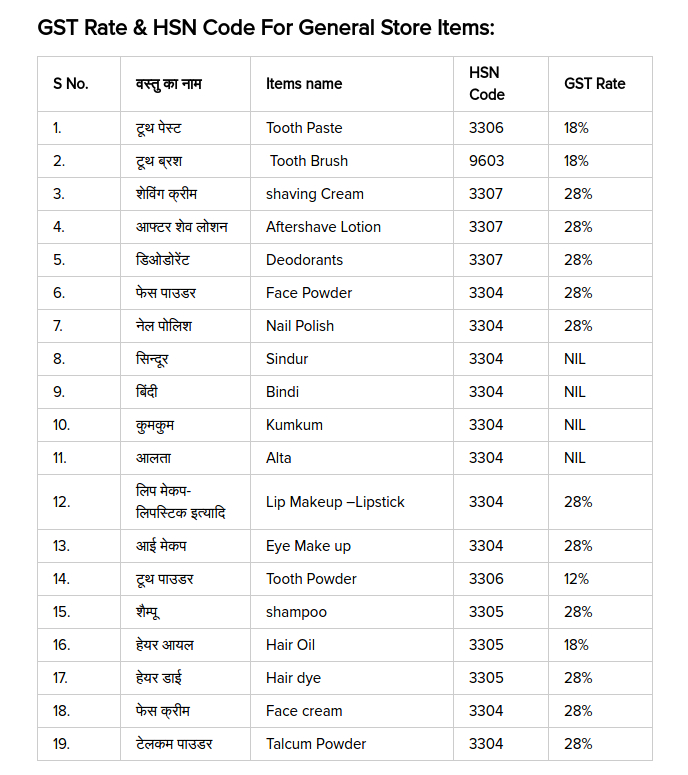

- Toiletries (HSN Code 3304): Toiletries, such as soaps, shampoos, and body washes, are generally subject to a GST rate of 18%.

5. Cleaning Tools and Equipment:

- Vacuum Cleaners (HSN Code 8508): Vacuum cleaners, used for maintaining cleanliness and removing dust and dirt, are typically subject to a GST rate of 18%.

- Mops and Brooms (HSN Code 9603): Mops and brooms, essential tools for cleaning floors, are usually subject to a GST rate of 18%.

- Dustpans and Brushes (HSN Code 9603): Dustpans and brushes, used for collecting and removing debris, are typically subject to a GST rate of 18%.

6. Storage and Organization:

- Storage Boxes and Containers (HSN Code 3923): Storage boxes and containers, used for organizing and storing items, are generally subject to a GST rate of 18%.

- Shelves and Racks (HSN Code 9403): Shelves and racks, providing storage space, are typically subject to a GST rate of 18%.

- Laundry Baskets (HSN Code 9603): Laundry baskets, used for collecting and transporting dirty laundry, are generally subject to a GST rate of 18%.

FAQs on HSN Codes and GST Rates for Housekeeping Items:

1. What if the HSN code for a housekeeping item is not readily available?

In cases where the specific HSN code is unclear, it is recommended to consult with a tax professional or refer to the official GST website for guidance.

2. Are there any exemptions or concessions on GST rates for specific housekeeping items?

The GST rates are subject to change, and specific exemptions or concessions may apply depending on the product and its intended use. It is essential to consult with relevant authorities for the most up-to-date information.

3. How can I find the HSN code for a particular housekeeping item?

The HSN code for a specific item can be found on the product packaging, online resources, or through consultation with a tax professional.

4. Can I claim GST input tax credit on purchases of housekeeping items?

Businesses registered under GST can claim input tax credit on purchases of housekeeping items, subject to specific conditions and regulations.

5. What are the penalties for incorrectly applying HSN codes and GST rates?

Incorrectly applying HSN codes and GST rates can lead to penalties, including fines and legal action. It is crucial to ensure accuracy and compliance with tax regulations.

Tips for Navigating HSN Codes and GST Rates for Housekeeping Items:

- Keep abreast of changes: GST rates and HSN codes are subject to change, so it is essential to stay informed about any updates or revisions.

- Seek professional guidance: For complex cases or when in doubt, consult with a tax professional to ensure accurate classification and compliance.

- Maintain proper documentation: Keep records of HSN codes and GST rates for all housekeeping items purchased or sold, facilitating easy reference and compliance with tax audits.

- Utilize online resources: Websites such as the official GST portal and tax-related publications can provide valuable information and guidance.

Conclusion:

Navigating the world of housekeeping items, HSN codes, and GST rates requires a clear understanding of the relevant regulations and classifications. This comprehensive guide has provided an overview of the key aspects, empowering individuals and businesses to make informed decisions, ensure compliance, and streamline financial transactions related to housekeeping products. By staying informed and seeking expert advice when necessary, individuals and businesses can navigate the complexities of taxation and maintain a well-organized and efficient approach to housekeeping.

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Housekeeping Items: Understanding HSN Codes and GST Rates. We appreciate your attention to our article. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply