Navigating The Landscape Of Goods: Understanding HS Codes And GST Rates

Navigating the Landscape of Goods: Understanding HS Codes and GST Rates

Related Articles: Navigating the Landscape of Goods: Understanding HS Codes and GST Rates

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape of Goods: Understanding HS Codes and GST Rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Goods: Understanding HS Codes and GST Rates

In the intricate web of global trade, accurate classification and taxation of goods are paramount. The Harmonized System (HS) Code, a globally recognized standardized system, plays a pivotal role in this process. Coupled with the Goods and Services Tax (GST), it forms a crucial framework for efficient trade and revenue collection. This article delves into the intricacies of HS Codes and GST rates, highlighting their significance in the modern economic landscape.

Understanding the HS Code: A Global Language for Goods

The HS Code, a six-digit numerical code, acts as a universal language for classifying goods traded internationally. Developed by the World Customs Organization (WCO), it provides a standardized system for identifying and categorizing goods, enabling seamless communication and efficient customs procedures.

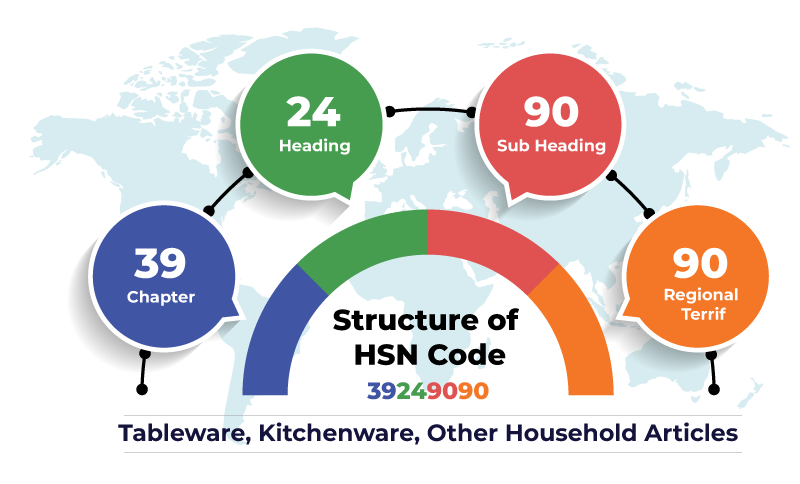

Structure and Significance of HS Codes

The HS Code is structured hierarchically, with each digit representing a specific level of detail. The first two digits represent the chapter, grouping goods into broad categories like "Live Animals" or "Mineral Products." The subsequent digits refine the classification, narrowing down to specific product types. For instance, the code 0101.10.00 refers to "Live horses, purebred breeding animals."

Benefits of the HS Code System:

- Streamlined Customs Procedures: The standardized classification facilitates efficient customs clearance, reducing delays and costs.

- Harmonized Trade Data: Consistent classification across countries enables accurate data collection and analysis for trade statistics and policy development.

- Fair and Transparent Taxation: A uniform system ensures equitable taxation across similar goods, promoting fair competition.

- Simplified Trade Documentation: The HS Code simplifies trade documentation, reducing administrative burdens on businesses.

GST Rates: A Crucial Component of India’s Tax System

The Goods and Services Tax (GST), introduced in India in 2017, is a comprehensive, multi-stage tax levied on the supply of goods and services. It has replaced a plethora of indirect taxes, simplifying the tax structure and fostering a unified market.

HS Code and GST Rate Linkage:

The HS Code plays a crucial role in determining the GST rate applicable to a particular good. The GST Council, a body comprising representatives from the central and state governments, assigns specific GST rates to different HS Codes. These rates can vary depending on the nature of the good, its essential use, and policy objectives.

Types of GST Rates in India:

- Zero Rate: Goods with a zero GST rate are exempt from tax, including essential items like food grains and raw materials.

- 5% Rate: This rate applies to goods considered essential but not strictly necessary, like certain food items and medicines.

- 12% Rate: A moderate rate for a wide range of goods, including consumer durables, electronics, and processed food.

- 18% Rate: A standard rate for a large category of goods, encompassing furniture, textiles, and automobiles.

- 28% Rate: The highest rate, applicable to luxury goods, tobacco products, and certain services.

Importance of HS Code and GST Rate Alignment:

Accurate classification using the HS Code is crucial for determining the correct GST rate. Misclassification can lead to incorrect tax payments, penalties, and legal complications. Businesses must ensure they accurately classify their goods based on the latest HS Code and GST rate information.

Navigating the Landscape: Practical Tips

- Consult with Experts: Engage with customs brokers, tax consultants, or industry associations for expert guidance on HS Code classification and GST rate determination.

- Stay Updated: Regularly monitor changes in HS Codes and GST rates, as these can be subject to periodic updates.

- Utilize Online Resources: Government websites like the Indian Customs Portal and the GST Council website provide comprehensive information and resources.

- Maintain Proper Documentation: Document all classification decisions and the rationale behind them, ensuring compliance and transparency.

- Seek Pre-Classification Ruling: For complex or ambiguous cases, businesses can seek pre-classification rulings from customs authorities for certainty.

FAQs on HS Codes and GST Rates:

1. How do I find the HS Code for a specific good?

You can find the HS Code for a specific good using online resources like the Indian Customs Portal or the GST Council website. Search by product name, description, or keywords to find the relevant code.

2. How do I determine the GST rate applicable to a particular good?

The GST rate for a good is determined by its HS Code. Consult the GST rate notification issued by the GST Council for the specific HS Code to find the applicable rate.

3. What happens if I misclassify a good under the HS Code?

Misclassifying a good can lead to incorrect tax payments, penalties, and legal complications. It is essential to ensure accurate classification based on the latest HS Code and GST rate information.

4. Are there any exemptions from GST?

Yes, certain goods and services are exempt from GST. These exemptions are specified in the GST Act and are subject to change.

5. How can I stay updated on changes in HS Codes and GST rates?

Subscribe to notifications from the Indian Customs Portal and the GST Council website. You can also consult with tax consultants or industry associations for updates.

Conclusion: A Cornerstone for Trade and Taxation

The HS Code and GST rate system form a crucial cornerstone for efficient trade and taxation in India. By ensuring accurate classification and applying the correct GST rates, businesses can navigate the complex landscape of international trade and contribute to a robust and transparent economic ecosystem. Continuous awareness and adherence to the latest regulations are essential for businesses to operate effectively and comply with the evolving legal framework.

![Understanding GST [Infographic]](https://www.pushbinary.com/wp-content/uploads/2016/08/GST.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Goods: Understanding HS Codes and GST Rates. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply