Navigating The Landscape Of Goods And Services: A Comprehensive Guide To HSN Codes And GST Rates

Navigating the Landscape of Goods and Services: A Comprehensive Guide to HSN Codes and GST Rates

Related Articles: Navigating the Landscape of Goods and Services: A Comprehensive Guide to HSN Codes and GST Rates

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape of Goods and Services: A Comprehensive Guide to HSN Codes and GST Rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Goods and Services: A Comprehensive Guide to HSN Codes and GST Rates

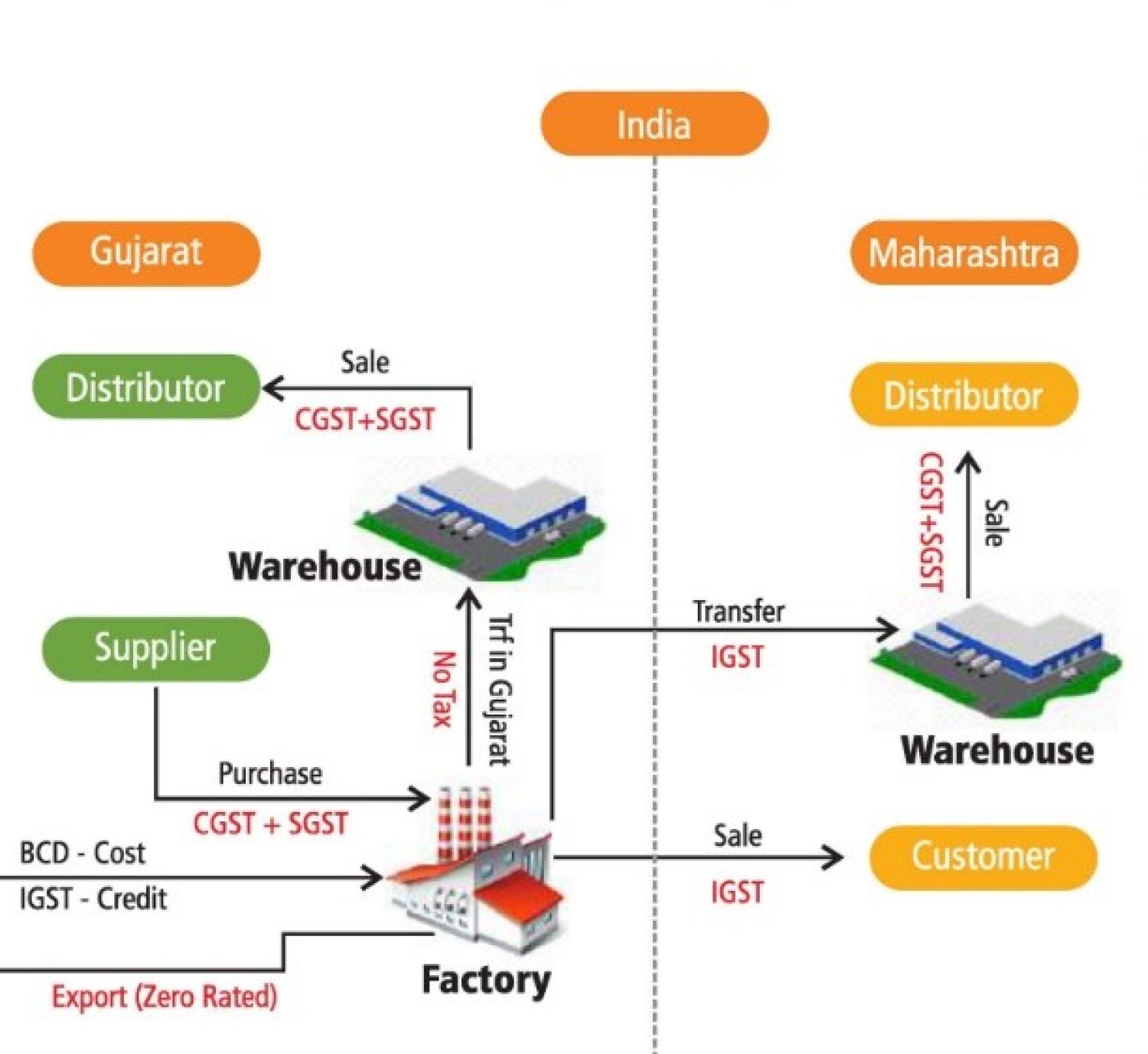

In the intricate world of commerce, accurate classification and taxation are paramount. The Indian government, through the Goods and Services Tax (GST) regime, has implemented a standardized system to streamline these processes. This system hinges on the Harmonized System (HS) Nomenclature – a globally recognized classification system for goods, and the corresponding GST rates that apply to them. This article delves into the intricacies of HSN codes and their associated GST rates, offering a comprehensive guide for navigating the complexities of this essential aspect of Indian trade.

Understanding the HSN Code: A Foundation for Efficient Trade

The Harmonized System Nomenclature (HSN) is an internationally standardized system for classifying traded goods. Developed by the World Customs Organization (WCO), it provides a six-digit code for each distinct product category, facilitating consistent identification and tracking across borders. This system ensures uniformity in customs procedures, simplifies international trade, and fosters a harmonious environment for global commerce.

Within the Indian context, the HSN code plays a crucial role in the GST regime. It serves as the foundation for determining the applicable GST rate on a specific product or service. The GST Council, comprising representatives from the central and state governments, designates GST rates for different HSN codes, ensuring a consistent and transparent tax structure across the country.

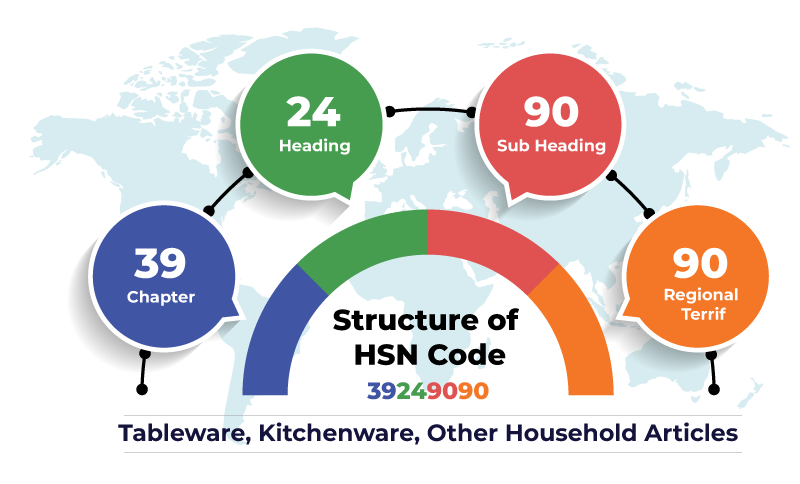

Decoding the HSN Code: A Step-by-Step Guide

The HSN code is a six-digit numerical code that classifies goods based on their nature, composition, and purpose. The first two digits represent the broad category, while the subsequent digits provide increasingly specific classifications. For instance:

- 01: Live animals

- 0101: Horses, asses, mules and hinnies; live

- 0101.10: Horses, purebred, for breeding

- 0101.20: Horses, other than purebred, for breeding

- 0101.90: Horses, other

This hierarchical structure allows for a detailed and comprehensive classification of goods, ensuring accuracy and clarity in tax calculations.

The GST Rate Structure: A Framework for Fair Taxation

The GST rates in India are categorized into four slabs: 0%, 5%, 12%, 18%, and 28%. These rates are applied to different HSN codes, reflecting the nature and importance of the goods or services. For instance, essential items like food grains and medicines often fall under the 0% or 5% slab, while luxury goods or items deemed harmful to health may be subject to higher rates.

The GST Council periodically reviews and updates the GST rates for different HSN codes, ensuring that the tax structure remains relevant and responsive to evolving economic conditions. This dynamic approach fosters a fair and equitable taxation system, promoting economic growth and stability.

Navigating the HSN Code List: A Practical Guide for Businesses

The HSN code list is a comprehensive document that outlines the classification of goods and their corresponding GST rates. This document is crucial for businesses, as it provides the foundation for accurate tax calculations and compliance. Businesses must carefully identify the appropriate HSN code for their products or services to ensure they are charged the correct GST rate.

Importance of HSN Code and GST Rate for Businesses:

- Accurate GST Calculation: The HSN code is fundamental for calculating the correct GST liability on each transaction. Using the wrong code can lead to financial penalties and legal repercussions.

- Simplified Compliance: By using the correct HSN code, businesses streamline their GST compliance process, reducing administrative burden and ensuring accurate tax reporting.

- Enhanced Transparency: The standardized HSN code system promotes transparency in trade, allowing for clear identification and tracking of goods across supply chains.

- Improved Business Efficiency: Accurate HSN code classification simplifies inventory management, logistics, and other operational aspects, leading to improved efficiency and cost savings.

Tips for Choosing the Right HSN Code:

- Consult the HSN Code List: The official HSN code list published by the government is the definitive source for classifying goods.

- Seek Professional Advice: If unsure about the correct HSN code for a specific product, consult with a tax professional or chartered accountant.

- Stay Updated: The GST Council periodically updates the HSN code list and GST rates. Businesses must stay informed about these changes to ensure compliance.

- Maintain Records: Keep detailed records of the HSN codes used for all transactions, facilitating accurate tax reporting and audits.

FAQs on HSN Codes and GST Rates:

1. What is the purpose of HSN codes?

HSN codes are a globally recognized system for classifying traded goods, ensuring uniformity in customs procedures, simplifying international trade, and fostering a harmonious environment for global commerce.

2. How do HSN codes relate to GST?

In India, HSN codes are used to determine the applicable GST rate for a specific product or service. The GST Council designates GST rates for different HSN codes, ensuring a consistent and transparent tax structure.

3. What are the different GST rates in India?

The GST rates in India are categorized into four slabs: 0%, 5%, 12%, 18%, and 28%. These rates are applied to different HSN codes, reflecting the nature and importance of the goods or services.

4. How can I find the correct HSN code for my product?

The official HSN code list published by the government is the definitive source for classifying goods. You can also consult with a tax professional or chartered accountant for assistance.

5. What happens if I use the wrong HSN code?

Using the wrong HSN code can lead to financial penalties and legal repercussions. It can also result in inaccurate tax reporting and compliance issues.

6. How often are HSN codes and GST rates updated?

The GST Council periodically reviews and updates the GST rates for different HSN codes, ensuring that the tax structure remains relevant and responsive to evolving economic conditions.

Conclusion: The Importance of HSN Codes and GST Rates in Modern Commerce

The HSN code list and GST rates are indispensable tools for navigating the complex world of commerce in India. They provide a clear and standardized framework for classifying goods, determining applicable taxes, and ensuring compliance with the GST regime. By understanding the intricacies of this system, businesses can optimize their operations, minimize tax liabilities, and contribute to a robust and transparent economic ecosystem. As the Indian economy continues to evolve, the importance of the HSN code list and GST rates will only grow, serving as the bedrock for a fair and efficient tax system.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Goods and Services: A Comprehensive Guide to HSN Codes and GST Rates. We thank you for taking the time to read this article. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply