Navigating The Landscape Of Goods And Services: A Comprehensive Guide To HSN Codes And GST Rates

Navigating the Landscape of Goods and Services: A Comprehensive Guide to HSN Codes and GST Rates

Related Articles: Navigating the Landscape of Goods and Services: A Comprehensive Guide to HSN Codes and GST Rates

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape of Goods and Services: A Comprehensive Guide to HSN Codes and GST Rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Goods and Services: A Comprehensive Guide to HSN Codes and GST Rates

The Goods and Services Tax (GST) regime in India, implemented in 2017, revolutionized the indirect tax system. A key component of this regime is the Harmonized System (HS) Nomenclature, a standardized international system for classifying traded goods. The Indian government adopted this system, incorporating it into the HSN Code List, which serves as the foundation for GST rate determination.

This article delves into the intricacies of HSN Codes, explaining their structure, significance, and the relationship with GST rates. It also addresses frequently asked questions and provides practical tips for navigating this crucial aspect of tax compliance.

Understanding the Structure and Purpose of HSN Codes

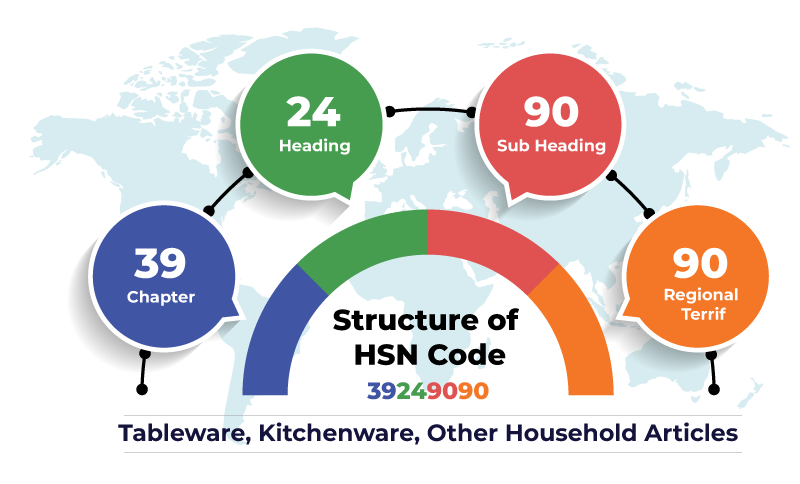

HSN Codes are six-digit numerical codes used to classify goods based on their nature and characteristics. The first two digits represent the broad category, while the subsequent digits provide increasing levels of specificity. For instance, 01 refers to "Live Animals," while 0101 denotes "Horses, asses, mules and hinnies, live." This hierarchical structure allows for a comprehensive and organized classification of goods.

The Significance of HSN Codes in the GST Regime

HSN Codes play a pivotal role in GST compliance, impacting various aspects of the tax system:

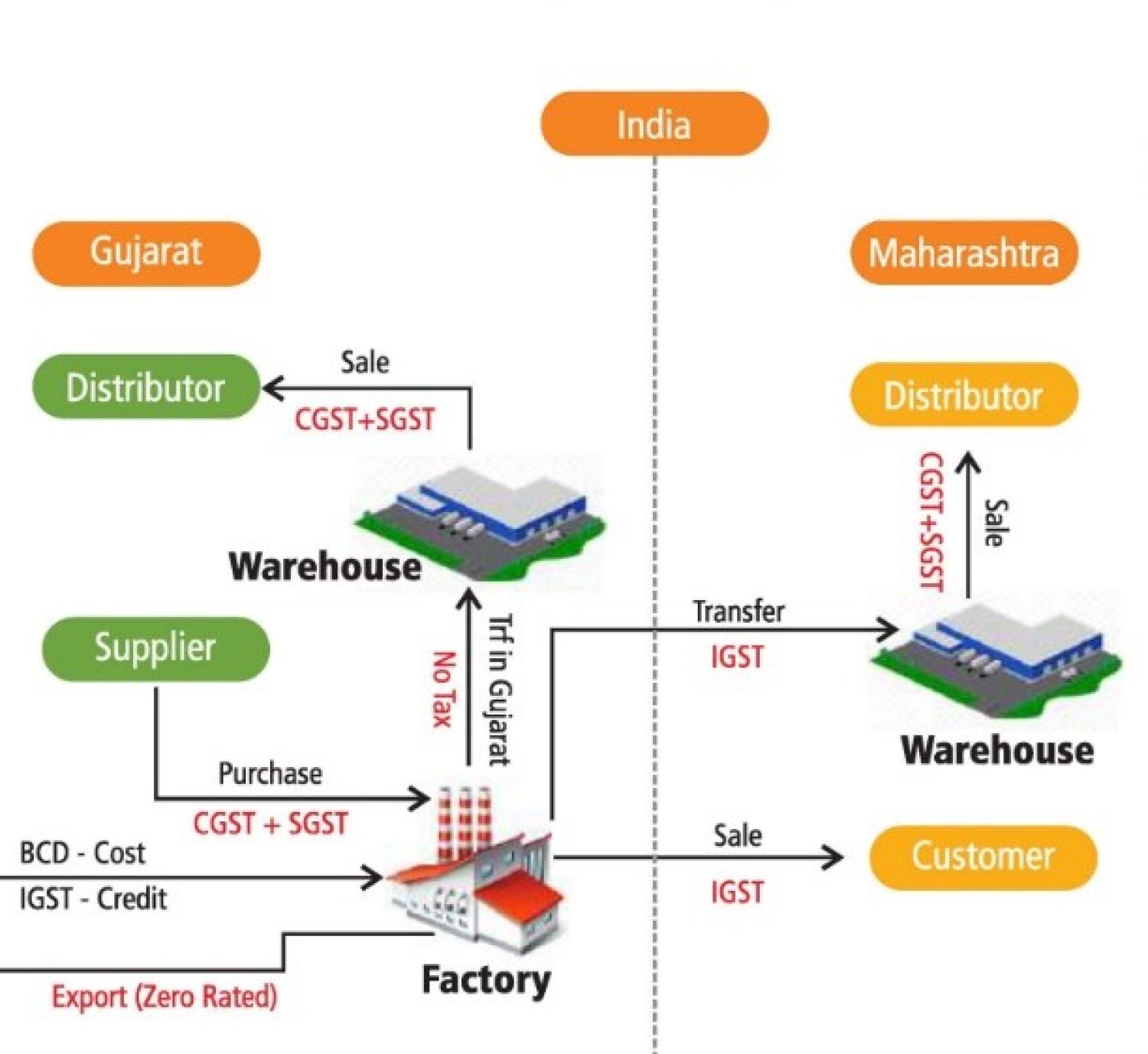

- GST Rate Determination: The HSN Code assigned to a good directly determines the applicable GST rate. The GST Council, a body comprising representatives from the central and state governments, decides the GST rates for different categories of goods, which are then linked to specific HSN Codes.

- Invoice Generation: HSN Codes are mandatory for generating invoices, ensuring accurate recording of goods traded and facilitating GST calculation.

- Tax Returns: HSN Codes are essential for filing GST returns, allowing for proper reporting of tax liability based on the specific goods traded.

- Tax Audits: Tax authorities utilize HSN Codes during audits to verify the accuracy of tax calculations and identify potential discrepancies.

- Trade Statistics: HSN Codes contribute to the collection of reliable trade statistics, providing valuable insights into the import and export patterns of goods.

Understanding the Relationship between HSN Codes and GST Rates

The GST Council periodically publishes a notification listing HSN Codes with corresponding GST rates. This notification serves as a reference guide for businesses, enabling them to determine the applicable GST rate for their goods based on their HSN Codes. The GST rates can vary based on factors such as:

- Nature of the good: Essential goods like food grains may attract a lower GST rate compared to luxury items like high-end automobiles.

- Purpose of the good: Goods used for industrial purposes may have different GST rates compared to goods intended for consumer use.

- State-specific variations: Some states may impose additional taxes or levies on specific goods, resulting in variations in the overall GST rate.

Navigating the HSN Code List: A Step-by-Step Guide

The HSN Code List is a comprehensive document containing over 5,000 codes, encompassing a wide range of goods. Navigating this list efficiently requires a systematic approach:

- Identify the broad category: Determine the general category of your good based on its nature. For instance, if you deal with electronics, you would refer to the relevant section in the HSN Code List.

- Refine the search: Use the sub-categories and specific descriptions within the selected category to narrow down your search and identify the most accurate HSN Code for your good.

- Verify the GST rate: Once you have identified the appropriate HSN Code, refer to the GST Council notification to determine the applicable GST rate.

FAQs: Unraveling the Mysteries of HSN Codes and GST Rates

Q: What happens if I use the wrong HSN Code?

A: Using an incorrect HSN Code can lead to various complications:

- Incorrect GST calculation: This can result in underpayment or overpayment of GST, leading to penalties and interest charges.

- Mismatched records: Discrepancies between the HSN Code on invoices and the HSN Code used for GST returns can raise red flags during tax audits.

- Delayed tax refunds: Using an incorrect HSN Code may delay the processing of tax refunds, impacting your cash flow.

Q: How frequently are the HSN Codes and GST rates updated?

A: The GST Council periodically reviews and updates the HSN Code list and associated GST rates. Businesses need to stay informed about these updates to ensure compliance with the latest regulations.

Q: What are the implications of changes in HSN Codes or GST rates?

A: Changes in HSN Codes or GST rates can affect businesses in various ways:

- Inventory valuation: Businesses may need to adjust the value of their inventory to reflect the new GST rates.

- Pricing adjustments: Businesses may need to revise their pricing strategies to account for changes in GST rates.

- Invoice amendments: Existing invoices may need to be amended to reflect the updated HSN Codes and GST rates.

Tips for Effective HSN Code Management

- Maintain a comprehensive HSN Code register: Create a dedicated register to record the HSN Codes of all goods you deal with, along with their corresponding GST rates.

- Regularly update the register: Ensure that your HSN Code register is updated whenever there are changes in the HSN Code list or GST rates.

- Seek professional advice: Consult with a tax professional or chartered accountant for guidance on HSN Code selection and GST compliance.

- Utilize online resources: Leverage online platforms and resources provided by the GST Council and other government agencies to access the latest information on HSN Codes and GST rates.

Conclusion: The Importance of HSN Codes in the GST Regime

HSN Codes are a crucial element of the GST regime, serving as a foundation for accurate tax calculation, compliance, and trade data analysis. Understanding the structure, significance, and relationship between HSN Codes and GST rates is essential for businesses to navigate the complexities of the GST system. By adhering to the guidelines, utilizing available resources, and seeking professional advice, businesses can effectively manage HSN Codes, ensure compliance, and optimize their GST processes.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Goods and Services: A Comprehensive Guide to HSN Codes and GST Rates. We thank you for taking the time to read this article. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply