Navigating The Labyrinth Of HSN Codes And GST Rates: A Comprehensive Guide

Navigating the Labyrinth of HSN Codes and GST Rates: A Comprehensive Guide

Related Articles: Navigating the Labyrinth of HSN Codes and GST Rates: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Labyrinth of HSN Codes and GST Rates: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Labyrinth of HSN Codes and GST Rates: A Comprehensive Guide

The world of international trade and domestic commerce is often complex and riddled with regulations. One such crucial aspect is the harmonized system nomenclature, commonly known as HSN codes, and the Goods and Services Tax (GST) rates associated with them. Understanding these codes and their corresponding GST rates is essential for businesses, importers, exporters, and consumers alike. This article aims to provide a comprehensive guide to HSN codes and GST rates, elucidating their significance and navigating their intricacies.

HSN Codes: A Universal Language of Goods

The Harmonized System (HS) is a globally standardized nomenclature system developed by the World Customs Organization (WCO). It classifies traded goods into a hierarchical structure, encompassing over 5,000 product categories, each assigned a unique six-digit code. This system serves as a universal language for international trade, facilitating seamless communication between customs authorities and businesses across borders.

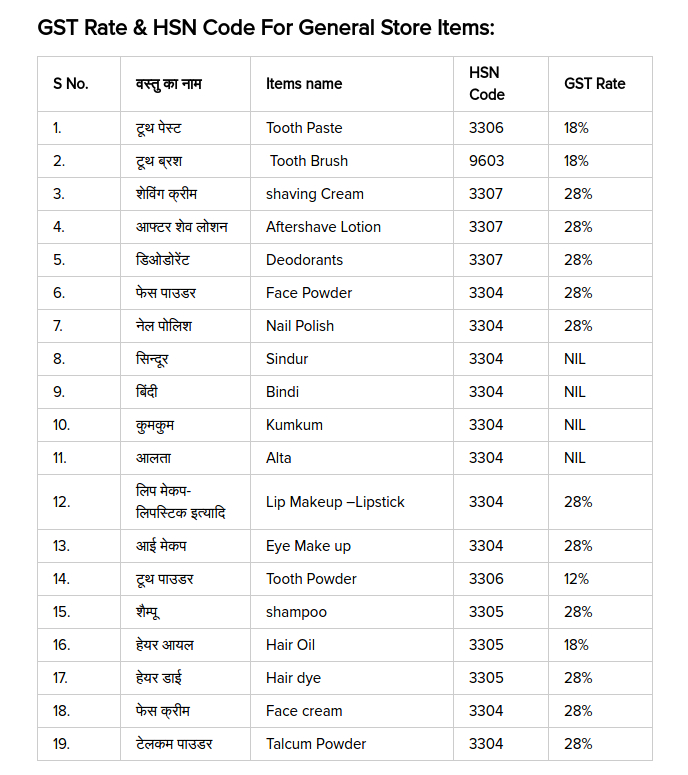

GST Rates: A Framework for Taxation

The Goods and Services Tax (GST) is a value-added tax levied on goods and services in India. The GST Council, comprising representatives from the central and state governments, determines the GST rates for various goods and services. These rates are classified based on the HSN codes, creating a system of taxation that is both comprehensive and transparent.

The Nexus Between HSN Codes and GST Rates

The relationship between HSN codes and GST rates is fundamentally intertwined. The GST Council utilizes the HSN code structure to categorize goods and services, subsequently assigning specific GST rates to each category. This system ensures that similar goods and services are taxed at the same rate, promoting fairness and consistency across the tax system.

Navigating the HSN Code Structure

HSN codes are structured hierarchically, with each subsequent digit providing a finer level of detail. The first two digits represent the broad category, while the subsequent digits refine the classification. For instance, HSN code 8517.11.00 represents "Electric Accumulators, Primary Cells and Primary Batteries, of a Kind Used for Motor Vehicles, Electric Vehicles and Other Vehicles, and for Railway Rolling Stock". The first two digits (85) denote "Electrical Machinery and Equipment and Parts Thereof; Sound Recorders and Reproducers, Television Image and Sound Recorders and Reproducers, and Parts and Accessories of Such Articles". Subsequent digits further refine the classification, ultimately arriving at the specific product category.

Understanding GST Rate Slabs

The GST Council has established four primary GST rate slabs:

- 0%: Goods and services considered essential or exempted from taxation.

- 5%: Goods and services deemed to be of lower value or essential for everyday consumption.

- 12%: Goods and services of moderate value and consumption.

- 18%: Goods and services considered more luxurious or non-essential.

- 28%: Goods and services classified as demerit goods, such as tobacco and alcohol.

The Importance of Correct HSN Code Classification

Accurate HSN code classification is crucial for various reasons:

- Tax Compliance: Misclassifying goods can result in incorrect GST calculation, leading to penalties and legal repercussions.

- Trade Facilitation: Correct HSN codes ensure seamless customs clearance, reducing delays and facilitating efficient trade.

- Data Analysis: Accurate HSN codes enable businesses to track their inventory, sales, and tax liabilities effectively.

- Market Research: HSN codes provide valuable insights into market trends, consumer preferences, and competitive landscapes.

FAQs: Demystifying HSN Codes and GST Rates

1. How can I find the correct HSN code for my product?

The GST Council’s website provides a comprehensive list of HSN codes and their corresponding GST rates. Alternatively, you can consult with a tax consultant or chartered accountant for assistance.

2. What happens if I use the wrong HSN code?

Using the wrong HSN code can lead to incorrect GST calculation, penalties, and potential legal issues. It is crucial to ensure accuracy in HSN code classification.

3. How often do HSN codes and GST rates change?

The GST Council may revise HSN codes and GST rates periodically based on economic and policy considerations. It is essential to stay updated on any changes to avoid compliance issues.

4. Are there any resources available to help me understand HSN codes and GST rates?

The GST Council’s website, along with various tax-related websites and publications, offer comprehensive resources on HSN codes and GST rates. Consulting with a tax professional is also recommended for specific guidance.

5. What are the implications of HSN code and GST rate changes on businesses?

Changes in HSN codes and GST rates can impact businesses in various ways, including:

- Price Adjustments: Changes in GST rates may necessitate price adjustments for goods and services.

- Inventory Management: Businesses need to adapt their inventory management strategies to reflect changes in HSN codes.

- Tax Compliance: Businesses must ensure their accounting systems are updated to reflect the revised HSN codes and GST rates.

Tips for Effective HSN Code and GST Rate Management

- Maintain Accurate Records: Keep detailed records of all transactions, including HSN codes and GST rates, to ensure accurate tax compliance.

- Stay Updated: Regularly monitor the GST Council’s website for any changes in HSN codes and GST rates.

- Seek Professional Advice: Consult with a tax professional for guidance on HSN code classification and GST rate calculation.

- Utilize Technology: Leverage accounting software and other technological tools to automate HSN code classification and GST rate calculation.

- Develop Internal Processes: Establish clear internal processes for HSN code management and GST rate application.

Conclusion: Embracing the Power of HSN Codes and GST Rates

Understanding HSN codes and GST rates is crucial for businesses, importers, exporters, and consumers alike. It enables accurate tax compliance, facilitates efficient trade, and provides valuable insights into market trends and consumer behavior. By embracing the power of these systems, businesses can navigate the complexities of the global economy with confidence and efficiency. Continuous learning, proactive compliance, and seeking professional guidance are key to optimizing HSN code and GST rate management, ensuring a smooth and successful journey in the world of commerce.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Labyrinth of HSN Codes and GST Rates: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply