Navigating The Kitchen: Understanding HSN Codes And GST Rates

Navigating the Kitchen: Understanding HSN Codes and GST Rates

Related Articles: Navigating the Kitchen: Understanding HSN Codes and GST Rates

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Kitchen: Understanding HSN Codes and GST Rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Kitchen: Understanding HSN Codes and GST Rates

The kitchen, a heart of every home, is filled with an array of items, each with its unique purpose and tax implications. Understanding the Harmonized System Nomenclature (HSN) codes and Goods and Services Tax (GST) rates associated with these kitchen essentials is crucial for businesses, consumers, and tax authorities alike. This article aims to provide a comprehensive overview of HSN codes and GST rates for common kitchen items, shedding light on their significance in the Indian market.

HSN Codes: A Universal Language for Goods

The HSN code system, developed by the World Customs Organization (WCO), provides a standardized classification for goods traded internationally. It is a hierarchical system with six-digit codes, where each digit represents a specific category. The first two digits define the broad category, while subsequent digits refine the classification to a more specific level.

GST: A Unified Tax System in India

The Goods and Services Tax (GST) is a value-added tax (VAT) implemented in India in 2017. It replaced a multitude of indirect taxes, creating a unified tax system across the country. GST rates vary based on the nature of goods and services, with different rates applicable for different categories.

Kitchen Items and their HSN Codes and GST Rates

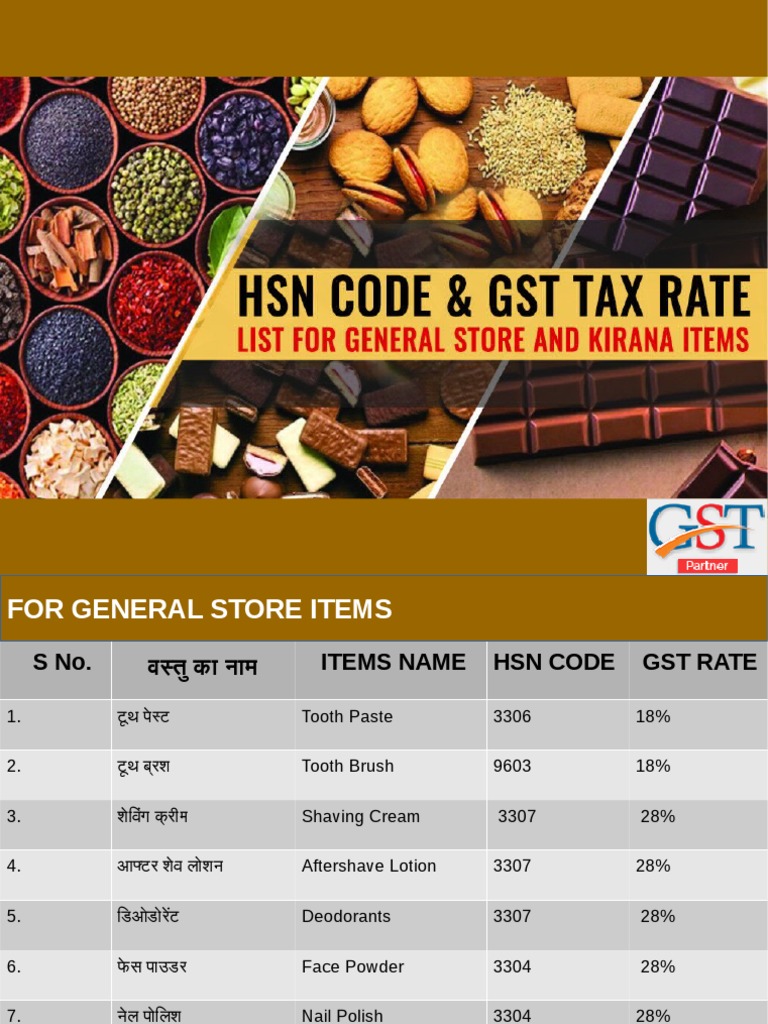

The following table provides a detailed breakdown of HSN codes and GST rates for common kitchen items:

| Item | HSN Code | GST Rate |

|---|---|---|

| Cookware | ||

| Pressure Cookers | 7323.90.00 | 18% |

| Non-stick Cookware | 7323.90.00 | 18% |

| Cast Iron Cookware | 7323.90.00 | 18% |

| Stainless Steel Cookware | 7323.90.00 | 18% |

| Utensils | ||

| Spoons, Forks, Knives | 7323.90.00 | 18% |

| Ladles, Spatulas, Whisks | 7323.90.00 | 18% |

| Chopping Boards | 4418.90.00 | 12% |

| Kitchen Appliances | ||

| Microwave Ovens | 8516.60.00 | 18% |

| Blenders | 8509.10.00 | 18% |

| Food Processors | 8509.10.00 | 18% |

| Toasters | 8516.71.00 | 18% |

| Kettles | 8516.71.00 | 18% |

| Refrigerators | ||

| Domestic Refrigerators | 8418.10.00 | 18% |

| Kitchenware | ||

| Plates, Bowls, Cups | 6911.10.00 | 12% |

| Glassware | 7013.91.00 | 12% |

| Cutlery | 7323.90.00 | 18% |

| Other Kitchen Items | ||

| Kitchen Sinks | 7324.10.00 | 18% |

| Kitchen Cabinets | 9403.10.00 | 18% |

| Kitchen Taps | 8481.80.00 | 18% |

Understanding the Significance of HSN Codes and GST Rates

The HSN codes and GST rates play a crucial role in various aspects of the kitchen industry:

- Accurate Tax Calculation: HSN codes ensure that the correct GST rate is applied to each item, ensuring accurate tax calculation and payment.

- Streamlined Business Operations: HSN codes facilitate efficient inventory management, purchase tracking, and tax compliance for businesses.

- Consumer Awareness: Consumers can use HSN codes to identify the GST rate applicable to specific kitchen items, allowing for informed purchasing decisions.

- Data Analysis and Policy Formulation: HSN codes and GST data provide valuable insights for policymakers to understand market trends, consumption patterns, and tax revenue collection.

FAQs on Kitchen Items, HSN Codes, and GST Rates

Q: Are there any specific rules for HSN code assignment for kitchen items?

A: The HSN code assignment for kitchen items follows the general guidelines outlined in the WCO Harmonized System. However, specific rules might exist for certain items based on their materials, functionality, or design. It is recommended to refer to the official HSN code manual or consult with a tax expert for specific queries.

Q: Can GST rates for kitchen items change?

A: Yes, GST rates can change based on government policies and economic factors. It is advisable to stay updated with the latest GST rate notifications and announcements.

Q: How can I find the HSN code for a specific kitchen item?

A: The HSN code for a specific kitchen item can be found in the official HSN code manual available on the website of the Central Board of Indirect Taxes and Customs (CBIC). You can also consult with a tax expert or use online tools specifically designed for HSN code lookup.

Q: What happens if the wrong HSN code is used for a kitchen item?

A: Using the wrong HSN code can lead to incorrect tax calculation, penalties, and legal complications. It is crucial to ensure that the correct HSN code is used for each item to avoid such issues.

Tips for Using HSN Codes and GST Rates Effectively

- Maintain accurate records: Keep detailed records of all kitchen items purchased or sold, including their respective HSN codes and GST rates.

- Stay updated on GST rate changes: Regularly check for any updates or changes in GST rates applicable to kitchen items.

- Consult with a tax expert: If you have any doubts or uncertainties regarding HSN codes or GST rates, seek professional advice from a tax expert.

- Utilize online resources: Explore online tools and resources that provide HSN code lookup and GST rate information.

Conclusion

Understanding HSN codes and GST rates for kitchen items is crucial for efficient business operations, informed consumer decisions, and accurate tax compliance. By adhering to the guidelines outlined in this article and staying updated on the latest information, individuals and businesses can navigate the kitchen industry with clarity and confidence. The knowledge of HSN codes and GST rates empowers stakeholders to make informed decisions, ensuring a smooth and compliant experience within the kitchen market.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Kitchen: Understanding HSN Codes and GST Rates. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply