Navigating The Estate: A Guide To Probate In The UK

Navigating the Estate: A Guide to Probate in the UK

Related Articles: Navigating the Estate: A Guide to Probate in the UK

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Estate: A Guide to Probate in the UK. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Estate: A Guide to Probate in the UK

The passing of a loved one is a deeply personal and emotional experience. Alongside grief, there arises the practical matter of managing their estate. This process, known as probate, involves the legal administration of a deceased person’s assets, ensuring their wishes are fulfilled and their property is distributed according to law. Understanding how probate works is crucial for both beneficiaries and executors, as it ensures a smooth transition of assets and provides clarity during a challenging time.

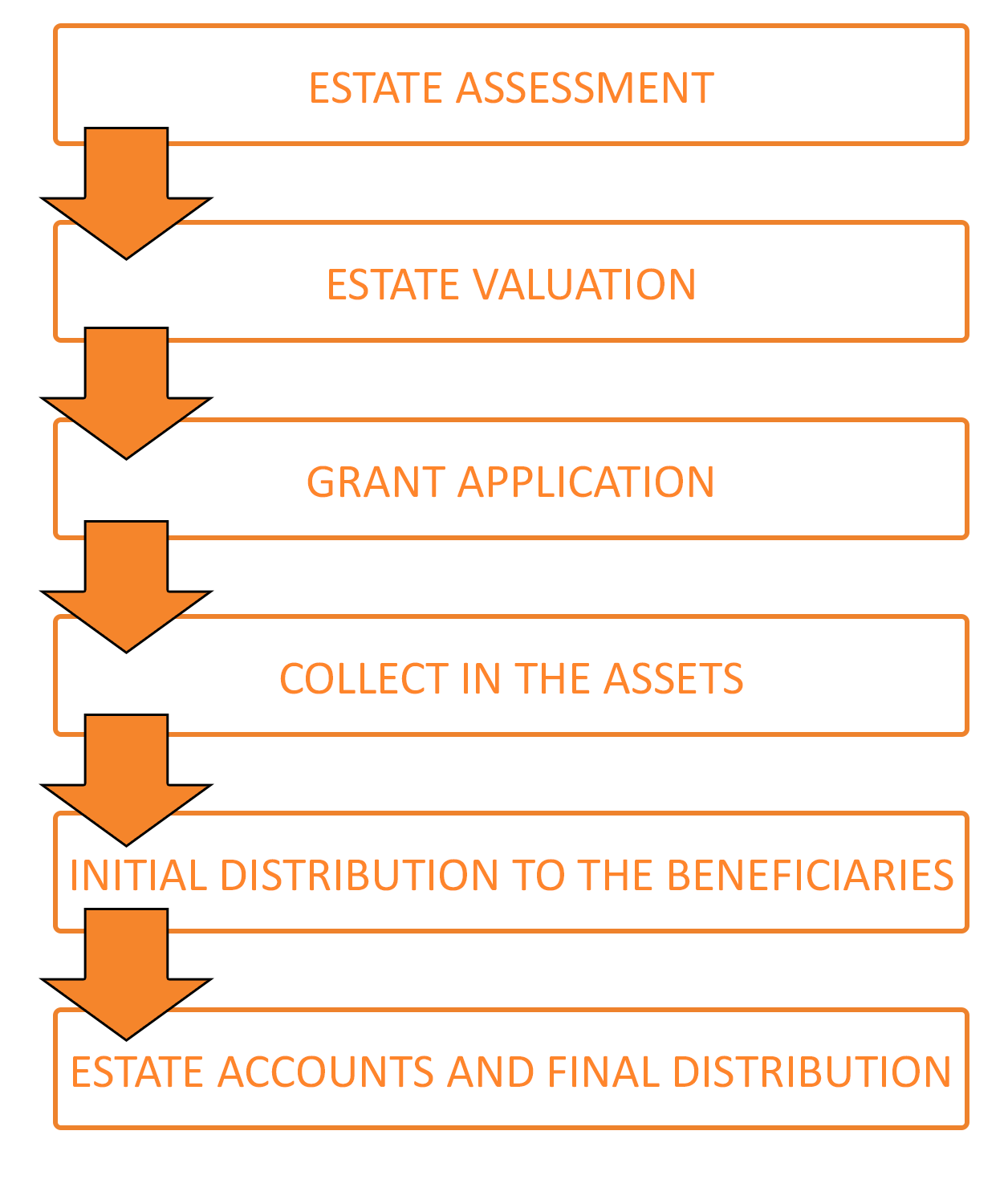

The Probate Process: A Step-by-Step Guide

-

Death Certificate and Grant of Probate: The process begins with the registration of the death and obtaining a death certificate. This document is essential for proving the deceased’s passing and initiating the probate process. If the deceased left a valid will, an application for a Grant of Probate must be made to the Probate Registry. This legal document empowers the executor(s) named in the will to manage the estate’s assets and distribute them according to the deceased’s wishes. If there is no will, a Grant of Letters of Administration is obtained, appointing an administrator to manage the estate.

-

Gathering Assets and Debts: The executor or administrator is responsible for gathering information about the deceased’s assets and liabilities. This includes identifying bank accounts, property, investments, personal belongings, and outstanding debts. Collecting relevant documentation, such as bank statements, property deeds, and loan agreements, is crucial for accurately assessing the estate’s value.

-

Paying Debts and Taxes: Once the assets and liabilities are identified, the executor or administrator must pay the deceased’s outstanding debts and taxes. This may include funeral expenses, council tax, utility bills, and any outstanding loans or mortgages. The estate is liable for inheritance tax if the value exceeds the current threshold, which is currently £325,000 for an individual and £650,000 for a married couple or civil partners.

-

Distributing Assets: After debts and taxes are settled, the remaining assets are distributed according to the deceased’s will or the rules of intestacy. Intestacy refers to the legal framework that determines how assets are distributed when a person dies without a valid will. The distribution process may involve transferring property ownership, distributing cash, and transferring shares or other investments.

Key Players in the Probate Process

- Executor: The person appointed in the will to manage the estate.

- Administrator: The person appointed by the court to manage the estate when there is no valid will.

- Beneficiary: The person(s) who will inherit from the deceased.

- Probate Registry: The government department responsible for issuing Grants of Probate and Letters of Administration.

- Solicitors: Legal professionals who can provide guidance and assistance throughout the probate process.

Why is Probate Important?

Probate plays a crucial role in ensuring the deceased’s wishes are fulfilled and their assets are distributed fairly. It provides legal authority to the executor or administrator, allowing them to access bank accounts, sell property, and settle debts. Furthermore, probate provides a legal framework for settling disputes that may arise between beneficiaries or creditors. Without probate, it would be difficult to prove ownership of assets and distribute them legally.

Benefits of Probate

- Ensures the deceased’s wishes are fulfilled.

- Provides legal authority to the executor or administrator.

- Facilitates the smooth transfer of assets to beneficiaries.

- Protects the estate from fraudulent claims.

- Resolves potential disputes between beneficiaries or creditors.

FAQs about Probate

Q: Do I need probate for every estate?

A: Probate is generally required if the estate’s value exceeds a certain threshold, which currently stands at £5,000 in England and Wales. However, there are exceptions, such as small estates with no property or complex assets.

Q: How long does the probate process take?

A: The duration of the probate process can vary depending on the complexity of the estate, the number of beneficiaries, and the efficiency of the executor or administrator. It can take anywhere from a few months to several years.

Q: How much does probate cost?

A: The cost of probate depends on the size and complexity of the estate and the level of legal assistance required. There are court fees associated with obtaining a Grant of Probate or Letters of Administration, as well as solicitor fees for legal services.

Q: Can I apply for probate myself?

A: It is possible to apply for probate yourself, but it is highly recommended to seek legal advice from a solicitor, especially if the estate is complex or involves property or investments. A solicitor can guide you through the process, ensure all legal requirements are met, and minimize the risk of errors or delays.

Tips for Managing Probate

- Gather all relevant documents: Collect death certificates, wills, bank statements, property deeds, and other relevant documents.

- Contact a solicitor: Seek legal advice from a qualified solicitor to navigate the complexities of probate.

- Be patient and organized: The probate process can be time-consuming, so maintain patience and keep accurate records.

- Communicate with beneficiaries: Keep beneficiaries informed about the progress of the estate and address any concerns promptly.

- Consider probate bonds: In some cases, a probate bond may be required to protect the estate from potential financial risks.

Conclusion

Probate is an essential legal process for managing the estate of a deceased person. It ensures the deceased’s wishes are fulfilled, assets are distributed fairly, and disputes are resolved effectively. By understanding the process and seeking legal advice when necessary, beneficiaries and executors can navigate this challenging time with clarity and confidence. It is crucial to remember that probate is not merely a bureaucratic exercise but a vital mechanism for honoring the legacy of the deceased and ensuring the smooth transition of their assets.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Estate: A Guide to Probate in the UK. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply