Navigating The Culinary Landscape: A Guide To Harmonized System Codes For Kitchen Items

Navigating the Culinary Landscape: A Guide to Harmonized System Codes for Kitchen Items

Related Articles: Navigating the Culinary Landscape: A Guide to Harmonized System Codes for Kitchen Items

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Culinary Landscape: A Guide to Harmonized System Codes for Kitchen Items. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Culinary Landscape: A Guide to Harmonized System Codes for Kitchen Items

The kitchen, a space where sustenance and culinary creativity converge, is a microcosm of human ingenuity. From basic utensils to sophisticated appliances, the items that populate this space are diverse and essential to daily life. Understanding the classification system used to categorize these items is crucial for various stakeholders, including importers, exporters, customs officials, and manufacturers. This system, known as the Harmonized System (HS) Code, provides a standardized framework for identifying and classifying goods traded internationally.

Decoding the HS Code System

The HS Code is an internationally recognized nomenclature system developed by the World Customs Organization (WCO). It utilizes a six-digit code structure, with each digit representing a specific level of detail in the classification hierarchy. The first two digits define the chapter, the next two digits define the heading, and the last two digits define the subheading. This system ensures consistent and accurate identification of goods across international borders, facilitating smooth trade and simplifying customs procedures.

Navigating the Kitchen Landscape: A Breakdown of HS Codes

The HS Code system encompasses a vast array of kitchen items, each categorized based on its material, function, and design. Here’s a comprehensive breakdown of key HS Codes relevant to kitchen items:

Chapter 73: Iron and Steel

- 73.21: Tableware and kitchenware, of iron or steel – This heading encompasses a wide range of items, including pots, pans, cutlery, kitchen knives, and other essential tools.

- 73.22: Other articles of iron or steel – This category includes various kitchen items like baking trays, roasting pans, and other specialized equipment.

Chapter 82: Tools, implements, cutlery, spoons and forks, of base metal

- 82.11: Hand tools, not elsewhere specified or included – This heading includes various kitchen tools such as whisks, spatulas, tongs, and other handheld instruments.

- 82.14: Tableware, kitchenware and other articles of cutlery, of base metal – This heading encompasses cutlery sets, individual pieces, and other related items.

- 82.15: Spoons, forks and other articles of cutlery, of base metal – This heading focuses specifically on spoons, forks, and other cutlery items.

Chapter 84: Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof

- 84.18: Refrigerating or freezing equipment – This heading includes refrigerators, freezers, and other refrigeration appliances commonly found in kitchens.

- 84.19: Washing machines and other laundry equipment – This heading encompasses washing machines, dryers, and other laundry appliances often used in kitchens or utility rooms.

- 84.21: Dishwashing machines – This heading specifically focuses on dishwashers used for cleaning dishes and other kitchenware.

- 84.24: Machinery and appliances for the preparation, preservation or processing of foodstuffs, not elsewhere specified or included – This heading includes a wide range of food preparation equipment, such as blenders, mixers, food processors, and other specialized appliances.

Chapter 94: Furniture; bedding, mattresses, mattress supports, cushions and similar stuffed furnishings; lamps and lighting fittings; prefabricated buildings

- 94.03: Kitchen furniture – This heading encompasses a variety of kitchen furniture, including cabinets, tables, chairs, and other items.

- 94.04: Other furniture – This heading includes various furniture items that might be found in kitchens, such as bar stools, serving carts, and other storage solutions.

Chapter 96: Articles of artificial resin or plastic

- 96.17: Tableware, kitchenware, other household articles and toilet articles, of plastics – This heading covers a wide range of kitchen items made from plastic, such as plates, bowls, containers, and other utensils.

The Importance of HS Codes: A Foundation for Efficient Trade

The HS Code system plays a crucial role in facilitating efficient international trade. Its benefits extend to various stakeholders:

- Importers and Exporters: HS Codes help importers and exporters correctly classify their goods, ensuring accurate documentation and compliance with customs regulations. This simplifies the import/export process, reduces delays, and minimizes the risk of penalties.

- Customs Officials: HS Codes provide a standardized framework for customs officials to identify and verify the nature of imported goods. This enables efficient customs clearance, prevents smuggling, and facilitates the collection of accurate import duties.

- Manufacturers: Understanding HS Codes allows manufacturers to accurately classify their products, facilitating market research, identifying potential export opportunities, and complying with international trade regulations.

Frequently Asked Questions (FAQs) about HS Codes for Kitchen Items

1. How do I find the correct HS Code for a specific kitchen item?

The most reliable way to determine the correct HS Code is to consult official resources provided by the World Customs Organization (WCO) or your national customs authority. These resources often include detailed descriptions, explanatory notes, and examples to help you accurately classify your goods.

2. Are there any resources available to assist in identifying HS Codes?

Yes, several online resources can assist you in finding the appropriate HS Code. Some popular options include:

- The World Customs Organization (WCO) website: This website provides access to the Harmonized System Nomenclature, including descriptions, notes, and examples.

- National Customs Authorities: Most countries have dedicated websites where you can access information about HS Codes and specific regulations related to importing and exporting goods.

- Specialized Trade Data Providers: Several companies specialize in providing trade data and HS Code information.

3. Can the HS Code for a kitchen item change over time?

Yes, HS Codes can be updated or amended periodically by the WCO to reflect changes in technology, manufacturing processes, or trade patterns. It’s essential to stay updated on any revisions or updates to ensure you are using the most current and accurate information.

4. What happens if I use the wrong HS Code?

Using the wrong HS Code can lead to various consequences, including:

- Delayed customs clearance: Incorrect classification can delay the release of your goods, impacting your supply chain and potentially leading to financial losses.

- Incorrect duty payments: Using the wrong HS Code might result in paying incorrect import duties, leading to financial penalties or additional charges.

- Legal issues: In some cases, misclassifying goods can lead to legal complications and fines.

Tips for Determining the Correct HS Code

- Consult official resources: Always refer to official sources like the WCO website or your national customs authority for accurate information.

- Be specific: Provide detailed descriptions of your product, including materials, functions, and any specific features.

- Consider similar products: Research HS Codes for similar products to gain insights into potential classifications.

- Seek expert advice: If you are unsure about the correct HS Code, consult a customs broker or an expert in international trade for assistance.

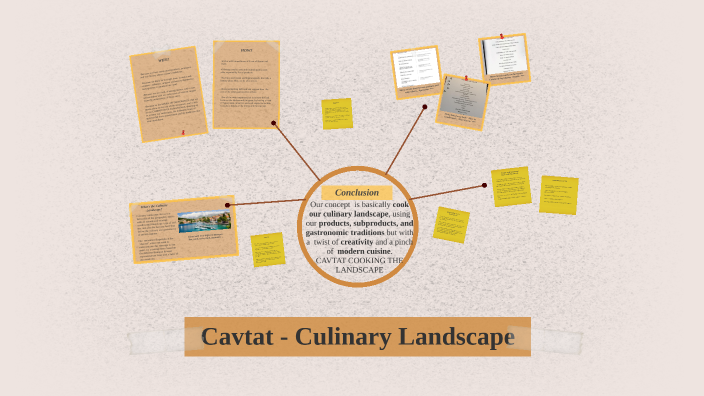

Conclusion

Understanding the Harmonized System Code is essential for navigating the global trade landscape, particularly when dealing with kitchen items. This standardized system provides a clear and consistent framework for classifying goods, facilitating efficient customs procedures and ensuring smooth international trade. By diligently researching and utilizing the correct HS Codes, businesses can optimize their import/export processes, minimize delays, and navigate the culinary landscape with confidence.

![What is HS Code? HS Code Explained [UPDATED 2024]](https://tradefinanceglobal.com/wp-content/uploads/2022/04/hscode.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Culinary Landscape: A Guide to Harmonized System Codes for Kitchen Items. We thank you for taking the time to read this article. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply