Determining The Value Of Household Goods: A Comprehensive Guide

Determining the Value of Household Goods: A Comprehensive Guide

Related Articles: Determining the Value of Household Goods: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Determining the Value of Household Goods: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Determining the Value of Household Goods: A Comprehensive Guide

- 2 Introduction

- 3 Determining the Value of Household Goods: A Comprehensive Guide

- 3.1 Understanding the Concept of Value

- 3.2 Methodologies for Estimating Value

- 3.3 Factors Affecting Value

- 3.4 Tips for Accurate Estimation

- 3.5 Importance of Accurate Valuation

- 3.6 FAQs: Estimating Household Goods Value

- 3.7 Conclusion

- 4 Closure

Determining the Value of Household Goods: A Comprehensive Guide

Accurately assessing the value of household possessions is essential for various reasons, ranging from insurance purposes to estate planning and even simple decluttering. Understanding the worth of your belongings provides clarity, allows for informed decisions, and ensures proper financial protection. This comprehensive guide will delve into the intricacies of estimating household goods value, equipping you with the knowledge and tools to confidently navigate this process.

Understanding the Concept of Value

Before delving into specific methods, it’s crucial to grasp the different types of value associated with household goods:

- Market Value: This refers to the price at which an item would sell in the current market. It considers factors like age, condition, brand, and demand.

- Replacement Value: This represents the cost of replacing an item with a new one of similar quality and functionality. It’s often used for insurance purposes.

- Sentimental Value: While not quantifiable in monetary terms, sentimental value reflects the emotional significance an item holds for its owner.

While sentimental value is important, it’s not typically considered when determining the financial worth of household goods for insurance or legal purposes.

Methodologies for Estimating Value

Several methods can be employed to estimate the value of household goods. The best approach depends on the specific situation and the level of accuracy required:

1. Online Marketplaces:

- Websites like eBay, Craigslist, and Facebook Marketplace offer insights into current market prices for similar items. By comparing listings for comparable goods, you can get a general sense of their value.

- Consider factors like condition, age, brand, and shipping costs when comparing prices.

- Remember that online marketplaces often reflect retail prices, not necessarily the actual sale price.

2. Appraisal Services:

- For high-value items like antiques, fine art, or jewelry, professional appraisals are highly recommended.

- Appraisers are trained experts who can accurately assess the value of such items based on their condition, provenance, and market demand.

- The cost of an appraisal varies depending on the item’s complexity and the appraiser’s expertise.

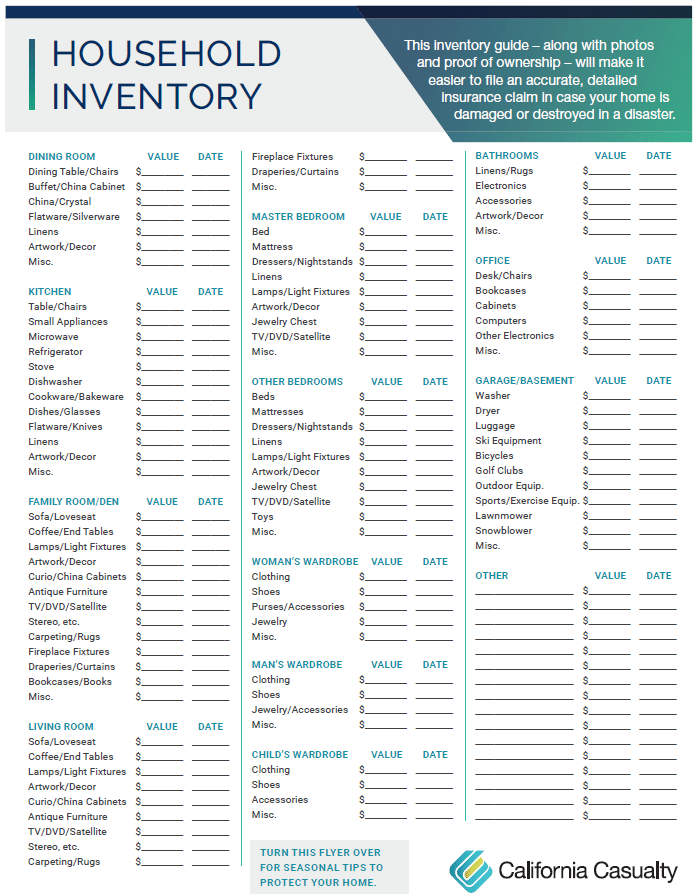

3. Inventory Lists and Replacement Cost:

- This method involves creating a detailed inventory of all household items, including descriptions and purchase dates.

- For each item, estimate the cost of replacement with a new item of similar quality.

- Online retailers, price comparison websites, and local stores can provide helpful information on replacement costs.

- Consider depreciation for older items, factoring in wear and tear.

4. Insurance Policies:

- Review your homeowner’s or renter’s insurance policy to understand how it defines and calculates the value of your belongings.

- Many insurance policies offer coverage based on replacement cost value, meaning they would pay to replace damaged or lost items with new ones.

- It’s crucial to ensure that your insurance policy provides sufficient coverage for the true value of your household goods.

5. Online Valuation Tools:

- Several websites and apps offer online valuation tools that can help estimate the value of household items based on user-inputted information.

- These tools typically use algorithms to compare user-submitted data with market trends and provide an estimated value.

- While these tools can be helpful, they are not always accurate and should be used with caution.

Factors Affecting Value

Numerous factors influence the value of household goods, and understanding them is crucial for accurate estimation:

- Age: Older items generally depreciate in value, especially furniture, electronics, and appliances.

- Condition: The condition of an item significantly impacts its value. Items in excellent condition command higher prices than those with wear and tear or damage.

- Brand: Certain brands are associated with higher quality and prestige, leading to increased value.

- Rarity: Unique or rare items often command higher prices than common ones.

- Demand: The demand for a particular item in the market plays a crucial role in its value.

- Provenance: The history and origin of an item can affect its value, especially for antiques and collectibles.

Tips for Accurate Estimation

- Be Realistic: Don’t overestimate the value of your belongings. Be honest about their condition and market demand.

- Document Everything: Keep receipts, appraisals, and any other documentation related to your household goods.

- Take Clear Photographs: Pictures of your belongings can be helpful for insurance claims and online sales.

- Research Thoroughly: Utilize online resources, price comparison websites, and local stores to gather information on comparable items.

- Seek Professional Advice: For high-value items or complex situations, consult with appraisers or other qualified professionals.

Importance of Accurate Valuation

Estimating the value of household goods serves several critical purposes:

- Insurance Coverage: Accurate valuation ensures adequate insurance coverage to protect your belongings in case of loss or damage.

- Estate Planning: Knowing the value of your possessions is essential for estate planning, ensuring fair distribution of assets among beneficiaries.

- Sale or Donation: Estimating value helps you determine a fair asking price for items you’re selling or the fair market value for charitable donations.

- Financial Planning: Understanding the worth of your possessions provides a clear picture of your overall financial standing.

FAQs: Estimating Household Goods Value

Q: What are the best ways to estimate the value of furniture?

A: For furniture, consider its age, style, condition, brand, and material. Online marketplaces, antique stores, and furniture retailers can provide helpful information.

Q: How do I estimate the value of electronics?

A: Electronics depreciate quickly. Check online retailers, price comparison websites, and manufacturer websites for current market prices. Consider the age, condition, and model.

Q: How do I estimate the value of art and collectibles?

A: For valuable art and collectibles, professional appraisals are highly recommended. Online auction sites and art galleries can offer insights into market trends.

Q: What is the difference between replacement value and market value?

A: Replacement value refers to the cost of replacing an item with a new one of similar quality. Market value reflects the current price an item would sell for in the market.

Q: Should I include sentimental value when estimating the value of my belongings?

A: Sentimental value is not typically considered for insurance or legal purposes. However, it’s important to consider when making personal decisions about your belongings.

Conclusion

Estimating the value of household goods is a crucial process with significant financial implications. By understanding the different types of value, employing appropriate methodologies, and considering relevant factors, you can accurately assess the worth of your belongings. This knowledge empowers you to make informed decisions about insurance coverage, estate planning, and the sale or donation of your possessions, ensuring you are adequately protected and financially prepared. Remember, accurate valuation is not just about numbers; it’s about ensuring the security and well-being of your assets and your future.

/five-determinants-of-demand-with-examples-and-formula-3305706-2022-02a2302a2f974d6c9c953f4a3be50889.png)

Closure

Thus, we hope this article has provided valuable insights into Determining the Value of Household Goods: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!

You may also like

Recent Posts

- The Ubiquitous "T": A Journey Through Objects And Concepts

- Navigating The World Of Household Waste Removal: A Comprehensive Guide

- Navigating The Aftermath: A Comprehensive Guide To Post-Mortem Planning

- The Science Of Slime: A Guide To Creating Viscous Fun From Common Household Ingredients

- A Culinary Journey: Exploring Kitchen Household Items And Their Significance

- Navigating The Local Market: A Guide To Selling Household Items

- The Essentials Of Human Existence: A Comprehensive Look At The Items We Need

- The Intriguing World Of Six-Inch Objects: Exploring Everyday Items With A Specific Dimension

Leave a Reply